If you’ve been feeling like organic search traffic is getting harder and harder to maintain, it’s not just you, and it’s not just your vertical.

In our industry, we’ve mostly attributed the decrease in organic search clicks to the rise of AI Overviews. And while AIOs are certainly growing in SERP presence, I wanted to assess if there were other factors at play.

My hypothesis was that the increase in text ads, as well as organic SERP features, could also be significant culprits for the decrease in classic organic search clicks across different verticals, potentially even more so than AIOs.

To test this, I used Similarweb data to analyze the SERP composition evolution across four verticals: the top 5,000 queries for headphones, jeans, and online games, plus the top 956 queries for greeting cards & ecards in the US. For each vertical I analyzed how clicks are distributed between classic organic results, organic SERP features, text ads, PLAs, zero-click searches, and AI Overviews; comparing January 2025 to January 2026.

I also looked at the top domains getting both organic and paid search clicks for each vertical across those same two periods, because the organic story only tells half the picture. The paid traffic data reveals how brands and retailers are actually responding to the organic squeeze.

The findings largely confirmed the hypothesis, with Text Ads (and PLAs in product categories) showing the biggest year-over-year shifts in click share. Let’s go through the data.

1. The evolution of SERP Composition and Clicks across these verticals

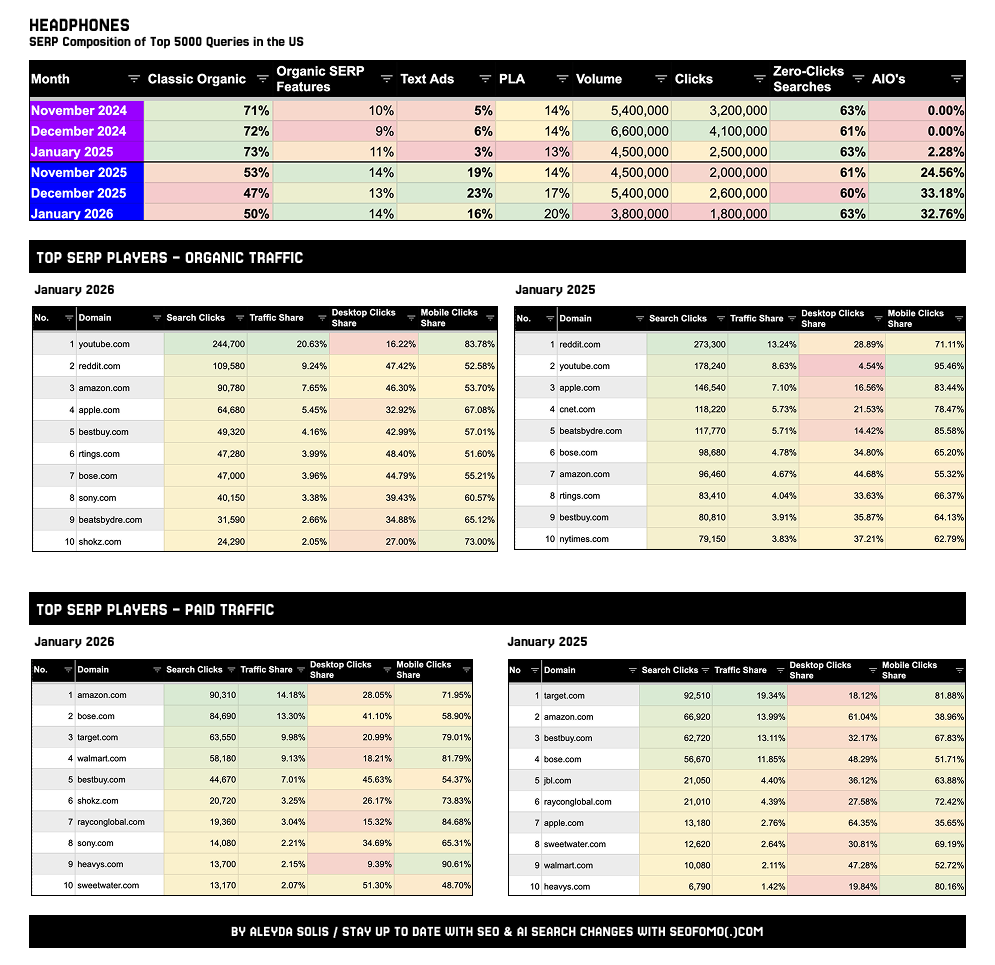

1.1. Headphones Top 5K Queries SERP composition (US)

For headphones, analyzing the top 5,000 queries in the US, I found the following shifts from January 2025 to January 2026:

SERP Composition: Major Shifts

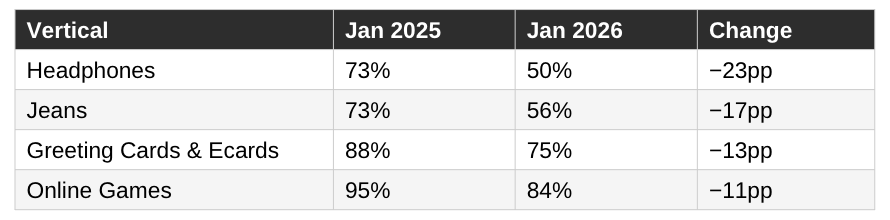

- Classic organic click share dropped from 73% to 50%: A 23 percentage point decline in a single year.

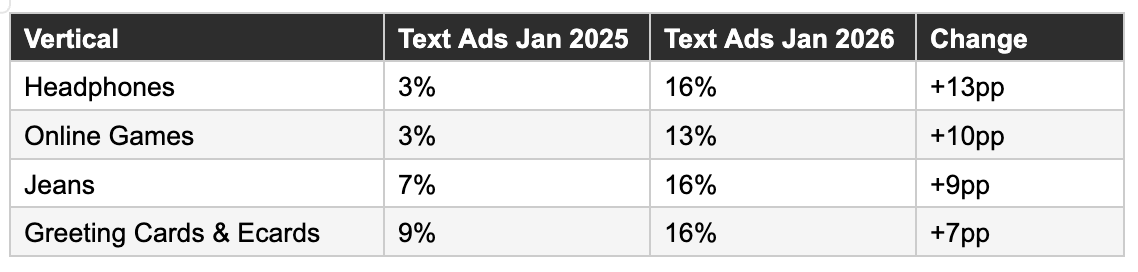

- Text Ads rose from 3% to 16% (+13pp) and PLAs from 13% to 20% (+7pp).

- PLAs also grew from 13% to 20%. Combined, paid results (text ads + PLAs) now capture 36% of clicks, up from 16%, more than doubling in one year.

- Organic SERP features grew modestly from 11% to 14%.

- Zero-click searches remained stable at 63%.

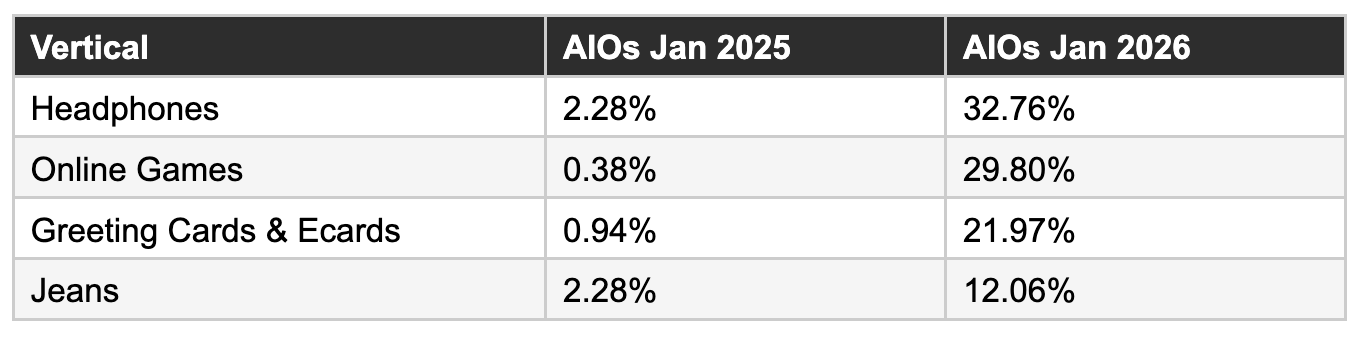

- AIO presence on SERPs exploded from 2.28% to 32.76%.

- Total clicks from the top 5K analyzed queries also declined from 2.5M to 1.8M, meaning classic organic isn’t just getting a smaller share, the total click volume is shrinking too (for these top queries).

Organic traffic: Who’s winning and losing clicks:

- YouTube is the big winner: it jumped from #2 (178K clicks) to #1 (244K): One of the very few sites to actually grow absolute organic clicks YOY.

- Reddit saw the biggest decline: from #1 (273K) to #2 (109K), losing 60% of its organic clicks.

- Publishers like CNET and NYTimes both disappeared from the top 10 entirely: CNET had 118K clicks in January 2025, NYTimes had 79K.

- Brands like Beatsbydre collapsed from #5 (117K) to #9 (31K), Apple dropped from 146K to 64K, and Bose from 98K to 47K.

- Retailers like Amazon and BestBuy both moved up in rank (#7 to #3 and #9 to #5 respectively) but only because others fell harder — both lost absolute volume.

Paid traffic: Who’s buying the clicks:

- Amazon moved from #2 (66K) to #1 (90K) in paid, a +35% increase, while its organic clicks also declined year over year.

- Walmart saw the most dramatic shift: from #9 (10K) to #4 (58K), a nearly 6x increase, despite not being in the organic top 10 at all.

- Bose increased from #4 (56K) to #2 (84K), a +49% increase.

- Target fell from #1 (92K) to #3 (63K), and BestBuy declined in both organic and paid.

- DTC brands like Shokz, Rayconglobal, and Heavys (which doubled from 6.7K to 13.7K) are investing heavily in paid.

- The overall paid competition intensified: the #10 spot went from 6.7K clicks to 13.1K, showing more players fighting for paid clicks across the board.

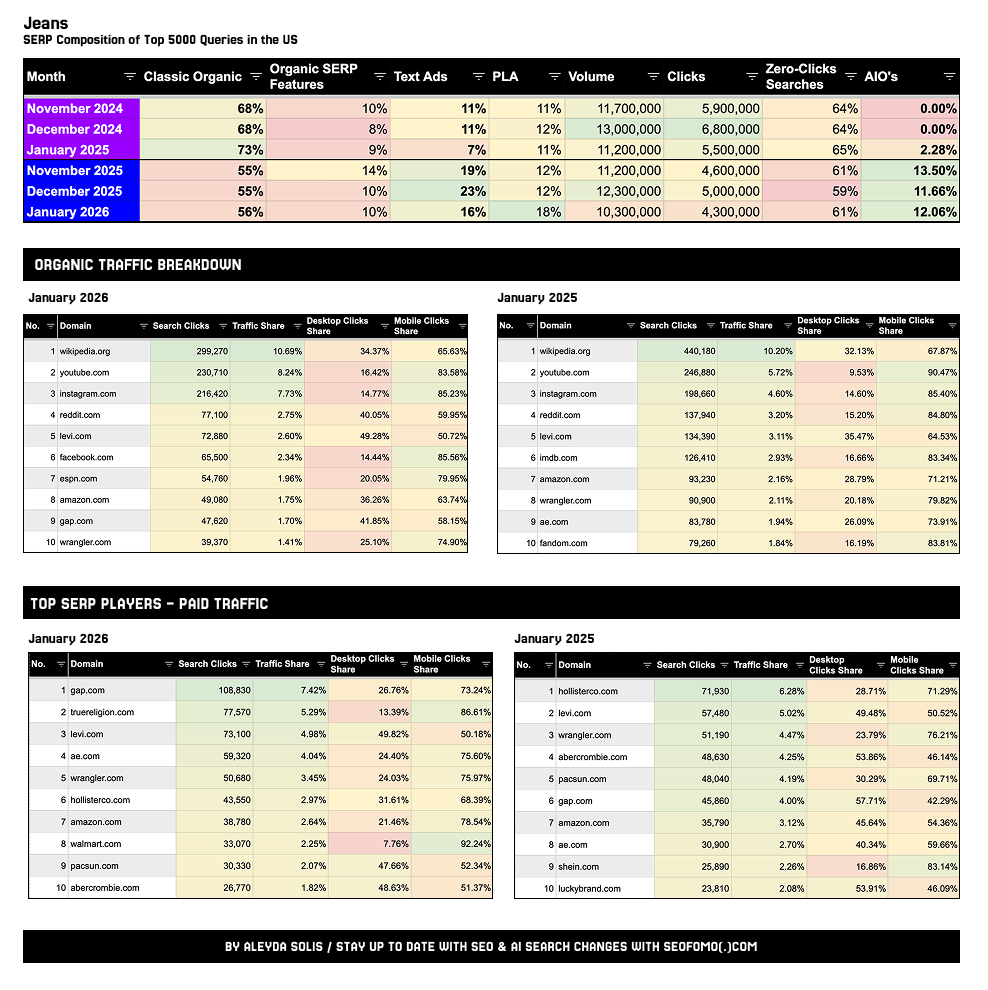

1.2. Jeans Top 5K Queries SERP composition (US)

For jeans, analyzing the top 5,000 queries in the US, I found the following shifts from January 2025 to January 2026:

SERP Composition: Major Shifts

- Classic organic click share dropped from 73% to 56%: A 17 percentage point decline.

- Text ads more than doubled, going from 7% to 16% (+9pp).

- PLAs also grew from 11% to 18% (+7pp). Combined, paid results (text ads + PLAs) now capture 34% of clicks, up from 18%.

- Organic SERP features barely moved, from 9% to 10%.

- Zero-click searches actually decreased slightly from 65% to 61%.

- AIO presence grew from 2.28% to 12.06%: significant but more moderate compared to headphones.

- Total clicks declined from 5.5M to 4.3M, so like headphones, the organic pie itself is also shrinking (at least the one going to top queries).

Organic traffic: Who’s winning and losing clicks:

- The top 3 positions are all non-retail platforms: Wikipedia (#1, 299K), YouTube (#2, 230K), and Instagram (#3, 216K). Instagram is particularly notable: it grew in absolute clicks from 198K to 216K, one of the very few sites to do so.

- Wikipedia and YouTube both lost absolute volume (440K to 299K and 246K to 230K respectively) but increased their traffic share, meaning they’re declining less than everyone else.

- Reddit dropped significantly from 137K to 77K (−44%).

- The biggest losers are the traditional retail and brand sites: Levi went from 134K to 72K (−46%), Wrangler from 90K to 39K (−57%), and Amazon from 93K to 49K (−47%).

- Facebook and ESPN entered the organic top 10 at #6 (65K) and #7 (54K) — more social/entertainment platforms filling the space that retailers and publishers lost.

- Gap appeared at #9 organically (47K), when it wasn’t in the organic top 10 at all in January 2025; while ae.com disappeared from the top 10 entirely, it had 83K clicks in January 2025.

Paid traffic: Who’s buying the clicks:

- Gap is the standout story: it went from #6 (45K) to #1 (108K), a 137% increase: The biggest paid growth.

- True Religion appeared at #2 with 77K paid clicks, when it wasn’t in the paid top 10 at all in January 2025.

- Levi grew from #2 (57K) to #3 (73K), a +27% increase.

- ae.com nearly doubled its paid investment from 30K (#8) to 59K (#4).

- Walmart entered the paid top 10 at #8 (33K) despite having no organic top 10 presence, buying its way into visibility.

- On the other side, Hollisterco fell from #1 (71K) to #6 (43K), Pacsun from #5 (48K) to #9 (30K), and Abercrombie from #4 (48K) to #10 (26K).

- Shein and Luckybrand both dropped out of the paid top 10 entirely.

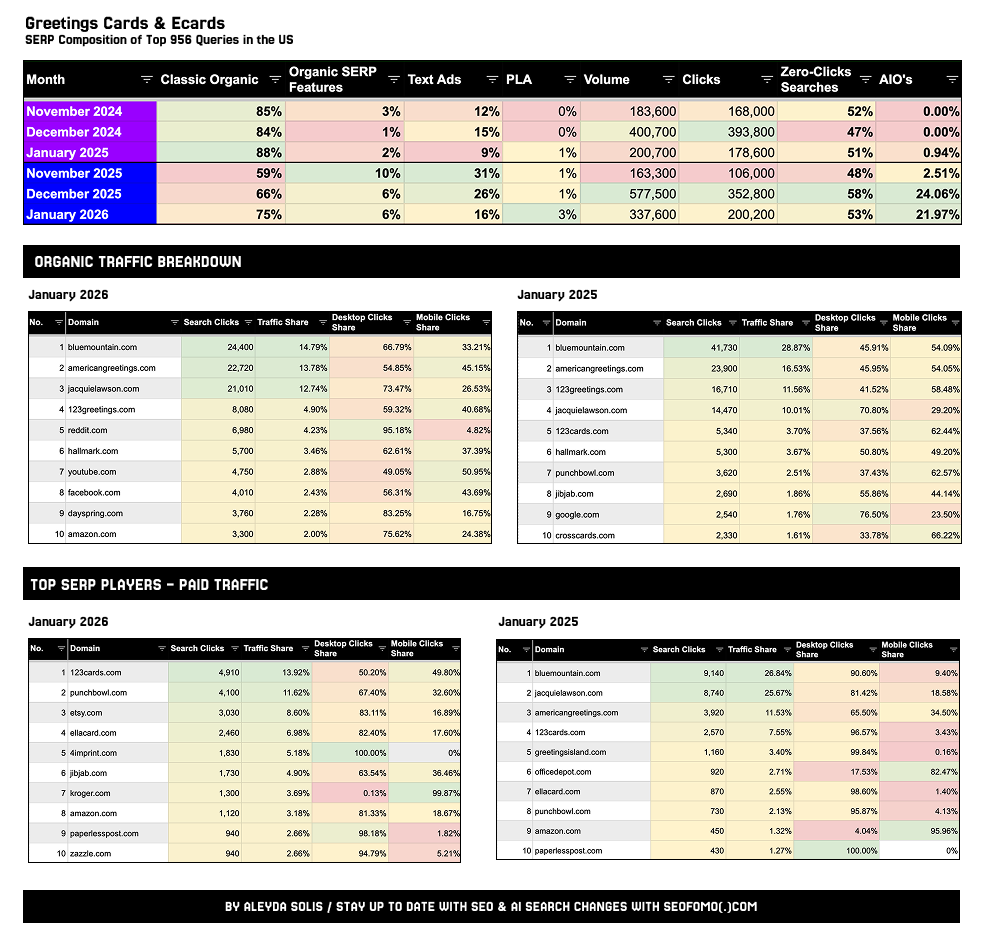

1.3. Greeting Cards & Ecards Top 956 Queries SERP composition (US)

For greeting cards & ecards, analyzing the top 956 queries in the US, I found the following shifts from January 2025 to January 2026:

SERP Composition: Major Shifts

- Classic organic click share dropped from 88% to 75%: A 13 percentage point decline. This vertical had one of the highest organic click share of the ones I analyzed in January 2025, so it had the most to lose.

- Text ads nearly doubled from 9% to 16% (+7pp).

- PLAs grew modestly from 1% to 3% (+2pp). Combined, paid results (text ads + PLAs) now capture 19% of clicks, up from 10%.

- Organic SERP features tripled from 2% to 6% (+4pp).

- Zero-click searches increased slightly from 51% to 53%.

- AIO presence jumped from 0.94% to 21.97%.

- Interestingly, unlike headphones and jeans, both total search volume (200K to 337K) and total clicks (178K to 200K) actually increased YOY. So the organic share is shrinking, but the overall pie of top queries is growing.

Organic traffic: Who’s winning and losing clicks:

- Bluemountain remains #1 but dropped significantly from 41K to 24K clicks (−41%). Still the dominant player, but losing ground fast.

- Jacquelawson.com is the surprise winner: it jumped from #4 (14K) to #3 (21K), a +45% increase, one of the very few sites across all verticals to meaningfully grow absolute organic clicks.

- Americangreetings held relatively steady: from 23K to 22K, moving from #2 to #2.

- 123greetings.com dropped sharply from #3 (16K) to #4 (8K), losing half its organic traffic.

- Reddit, YouTube, and Facebook all entered the organic top 10: At #5 (6.9K), #7 (4.7K), and #8 (4K) respectively. None of them were in the top 10 in January 2025. The same pattern of social and UGC platforms filling organic space that we see across other verticals.

- 123cards, Punchbowl, Jibjab, Google.com, and Crosscards all dropped out of the organic top 10.

- Amazon and Dayspring entered the organic top 10 at #10 (3.3K) and #9 (3.7K).

Paid traffic: Who’s buying the clicks:

- The biggest shift here is a complete change of the paid leaderboard. Bluemountain dominated paid in January 2025 at #1 (9.1K clicks) and dropped out of the paid top 10 entirely in 2026. Jacquelawson did the same: from #2 (8.7K) to nowhere in the top 10. The two former paid leaders essentially pulled back their ad investment.

- 123cards took over as #1 in paid (4.9K), nearly doubling from #4 (2.5K) a year ago.

- Punchbowl saw the most dramatic growth: from #8 (730 clicks) to #2 (4.1K) — a 5.6x increase.

- Etsy entered the paid top 3 at #3 (3K). It wasn’t in the paid top 10 at all in 2025, bringing marketplace competition into this niche.

- Ellacard nearly tripled from #7 (870) to #4 (2.4K).

- Several new entrants appeared in the paid top 10: 4imprint (#5, 1.8K), Jibjab (#6, 1.7K), Kroger (#7, 1.3K), and Zazzle (#10, 940). These are a mix of promotional product companies and creative marketplaces, showing how the competitive landscape for paid is diversifying beyond traditional greeting card sites.

- Amazon more than doubled its paid investment from 450 to 1.1K.

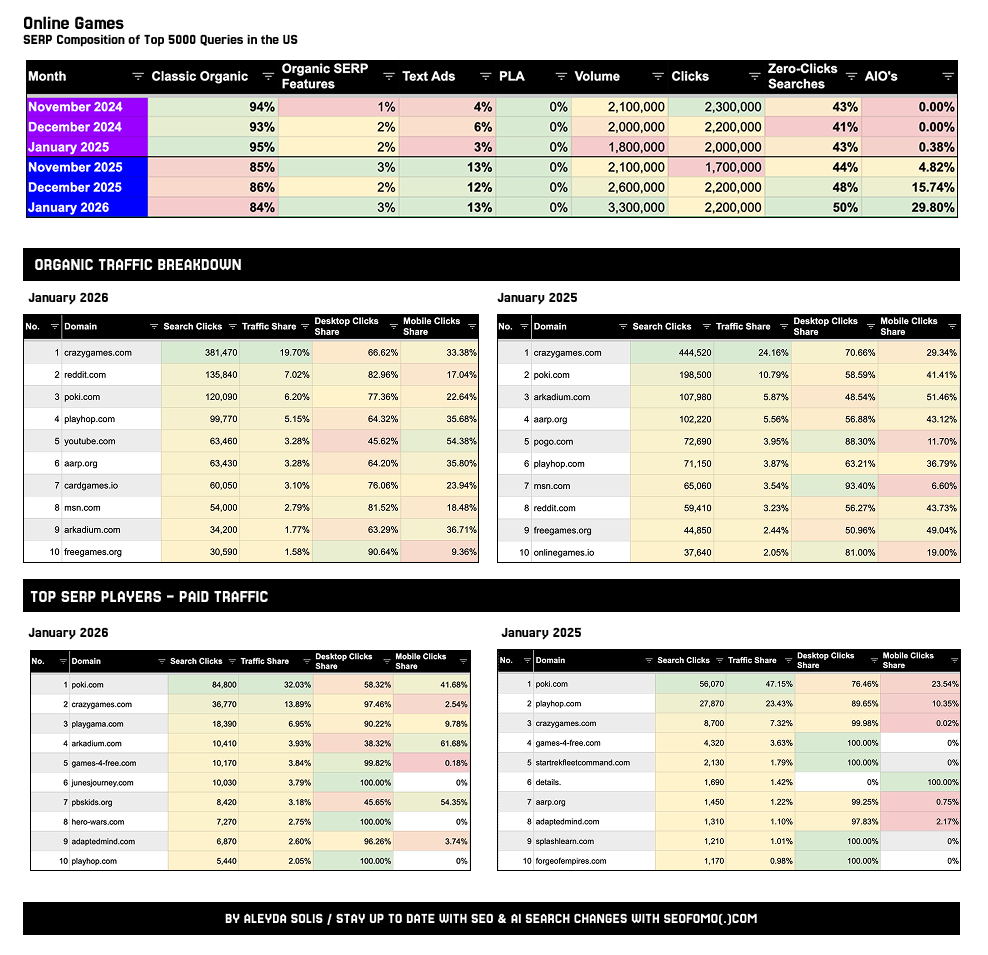

1.4. Online Games Top 5K Queries SERP composition (US)

For online games, analyzing the top 5,000 queries in the US, I found the following shifts from January 2025 to January 2026:

SERP Composition: Major Shifts

- Classic organic click share dropped from 95% to 84%: An 11 percentage point decline. This was the most “organic-friendly” vertical of all, with the highest starting organic share.

- Text ads more than quadrupled from 3% to 13% (+10pp). This is notable for a vertical that historically had almost no ad presence.

- PLAs remain at 0%, this isn’t a product vertical.

- Organic SERP features barely moved, from 2% to 3%.

- Zero-click rose from 43% to 50% alongside a sharp increase in AIO presence (0.38% to 29.80%).

- AIO presence surged from 0.38% to 29.80% — the second-highest AIO growth after headphones.

- Both search volume (1.8M to 3.3M) and total clicks (2M to 2.2M) increased YOY. This is a growing market, but the click growth didn’t keep pace with volume growth, suggesting more searches are going zero-click.

Organic traffic: Who’s winning and losing clicks:

- CrazyGames remains #1 but declined from 444K to 381K (−14%). It still dominates with nearly 20% traffic share, but the gap is narrowing.

- Reddit is the biggest organic winner: from #8 (59K) to #2 (135K), more than doubling its organic clicks. A massive jump that mirrors the pattern we see across other verticals.

- Poki dropped significantly from #2 (198K) to #3 (120K), losing 39% of its organic traffic.

- Playhop bucked the trend: it grew from #6 (71K) to #4 (99K), a +40% increase, one of the few gaming platforms to grow absolute organic clicks.

- YouTube entered the organic top 10 at #5 (63K): It wasn’t present in 2025. Yet another vertical where YouTube is gaining organic ground.

- Arkadium saw the most dramatic organic collapse: from #3 (107K) to #9 (34K), losing 68% of its organic clicks.

- Aarp.org declined from #4 (102K) to #6 (63K), losing 38%.

- Pogo.com and Onlinegames.io both dropped out of the organic top 10 entirely — they had 72K and 37K clicks respectively in January 2025.

- Cardgames.io entered the organic top 10 at #7 (60K).

Paid traffic: Who’s buying the clicks:

- The overall paid market exploded: the top 10 paid sites combined for roughly 198K clicks in January 2026, nearly double the ~106K in January 2025.

- Poki remains #1 in paid and grew from 56K to 84K (+51%), but its paid traffic share actually dropped from 47% to 32%, because the overall paid pie grew so much. Poki is clearly investing heavily to compensate for its 39% organic decline.

- CrazyGames had the most dramatic paid escalation: from #3 (8.7K) to #2 (36K), more than quadrupling its paid investment. This while also declining organically (444K to 381K).

- Playgama appeared at #3 with 18K paid clicks: It wasn’t in the paid top 10 at all in 2025. A completely new paid entrant.

- Arkadium entered the paid top 10 at #4 (10.4K): Not present in paid in 2025. This mirrors its organic decrease (−68%), suggesting a strategic pivot from organic to paid.

- Playhop tells the opposite story: its organic grew +40% but its paid investment dropped from #2 (27K) to #10 (5.4K). One of the few sites that successfully shifted away from paid reliance and toward organic growth.

- Several new entrants appeared in the paid top 10: Junesjourney (#6, 10K), Pbskids.org (#7, 8.4K), and Hero-wars.com (#8, 7.2K): A mix of casual and mobile game brands entering paid search competition.

- Startrekfleetcommand, Splashlearn, and Forgeofempires all dropped out of the paid top 10.

2. What do these SERP shifts tell us?

Now that we’ve gone through each vertical individually, let’s zoom out and look at what holds true across all four.

2.1. Classic Organic Click Share Is Declining Across Every Single Vertical

The most consistent finding across all four verticals is a significant year-over-year decline in the percentage of clicks going to classic organic results from January 2025 to January 2026:

This isn’t a subtle shift. Headphones lost nearly a quarter of its classic organic click share in a single year. Even online games, which has been one of the most “organic-friendly” verticals historically (with no PLAs and minimal ads), dropped 11 percentage points.

2.2. Text ads are the biggest winner across every vertical

Text ads roughly tripled or quadrupled their click share across every single vertical.

In headphones, text ads gained +13 percentage points; in online games, +10; in jeans, +9; and in greeting cards, +7. This is the most consistent finding in the entire analysis.

Product verticals are getting a double hit: text ads + PLAs

- Headphones: PLA share went from 13% to 20%. Combined with text ads (16%), paid results now capture 36% of all clicks, up from 16% a year ago.

- Jeans: PLA share went from 11% to 18%. Combined with text ads (16%), that’s 34% of clicks going to paid, up from 18%.

- Greeting Cards: PLA share grew from 1% to 3%, with text ads at 16%. That’s 19% total paid, up from 10%.

The paid click share has effectively doubled in product verticals within just one year.

2.3. AIO penetration is highly vertical-dependent

AIO presence is growing fast across all four verticals, but the growth varies dramatically: From over 30 percentage points in headphones to about 10 in jeans.

Important: this is AIO presence, not click attribution. We can see AIOs appearing on more SERPs, but this dataset doesn’t show how many clicks they capture or prevent.

2.4. Zero-click searches are high but mostly stable

- Headphones: 63% (stable YOY)

- Jeans: 65% to 61% (slight decrease)

- Online Games: 43% to 50% (notable increase, alongside a rise in AIO presence)

- Greeting Cards: 51% to 53% (slight increase)

Zero-click rates are high and mostly stable (except Online Games). At the same time, Classic Organic click share is down while Text Ads are up in every vertical; so when clicks do happen, a larger share is going to paid surfaces than a year ago.

2.5. The organic-to-paid migration cycle is self-reinforcing

Across verticals, the sites losing organic clicks are the very same ones ramping up paid investment. Amazon, Walmart, Bose, CrazyGames; they’re all compensating for organic losses by buying their way back into SERPs.

Others like Gap and True Religion are leaning harder into paid, and in True Religion’s case, it shows up as a major paid player without appearing in the organic top 10 list shown.

This can become self-reinforcing in practice: as classic organic click share declines and competition intensifies, more players appear to increase paid investment (as seen in the paid click leaderboards shifting and/or thickening year over year).

2.6. The search landscape isn’t just shifting to AI, it’s fundamentally being remonetized.

When I started this research, my hypothesis was that text ads and organic SERP features -not just AI Overviews- could be significant culprits behind declining organic clicks.

The data confirmed this across all four verticals, and the scale of the text ad impact surprised me: they gained between +7 and +13 percentage points of click share in every vertical, making them the single biggest measurable driver of the organic decline.

Organic SERP features also contributed, adding +1 to +4 percentage points depending on the vertical. Meanwhile, AIO SERP presence expanded dramatically but varied widely: from 12% in jeans to nearly 33% in headphones.

Across these four verticals, Text Ads show a clear year-over-year increase in click share (+7 to +13pp), while AI Overviews show a clear year-over-year increase in SERP presence (ranging from +~10pp to +~30pp depending on the vertical). These are two separate shifts happening at the same time.

3. What Should You Do About All of This?

Based on these findings, here’s what I’d recommend:

3.1. Stop treating the organic decline as just an “AIO problem”

Yes, AIOs are growing in SERP presence. But text ads are capturing far more organic share right now, and that’s directly measurable.

Your competitive analysis should include paid SERP players, not just organic ones. Understand who’s buying the clicks in your space and what that means for the achievable organic click share.

3.2. Monitor SERP composition for your specific vertical

The differences between verticals are dramatic. Online games still has 84% classic organic click share, while headphones is at 50%. Your strategy needs to be calibrated to your specific SERP reality, not industry averages or generalized takes.

3.3. Invest in what organic rewards now: video, UGC, and brand authority

YouTube’s growth across verticals is a clear signal. So is the rise of social platforms like Instagram and Reddit in organic results.

Invest in the destinations that are gaining organic clicks in your SERPs. In this data, that includes YouTube (notably in headphones, and present in online games), Reddit (notably in online games), and Instagram (notably in jeans).

If you’re a brand, you need presence and content across these platforms, not just your own site.

3.4. Recalibrate your paid strategy

If organic click share in your vertical has dropped 11-23 percentage points, your previous organic-to-paid traffic ratio assumptions are outdated.

Paid click share (Text Ads + PLAs) increased sharply in the product verticals here: Headphones 16% to 36%, Jeans 18% to 34%, Greeting Cards 10% to 19%

This may mean increasing paid budgets, but it should also mean finding efficiencies: the competition for paid clicks is intensifying and costs will rise.

3.5. Track pixel visibility and click behavior, not just rankings

Traditional position tracking doesn’t capture this reality. You need to monitor SERP features, click distribution, and the actual share of clicks going to organic vs. paid vs. zero-click.

Tools like Similarweb, and others that provide SERP composition data are essential for understanding where you actually stand.

3.6. Stay up to date about the latest search shifts and test

Subscribe to the SEOFOMO newsletter for free to stay up to date with the latest SEO & AI Search changes, and start testing based on the trends and patterns you see in your vertical.