Who are the top Black Friday Organic Search Traffic Winners in 2025? What are their main characteristics? What can we learn to maximize your traffic next year?

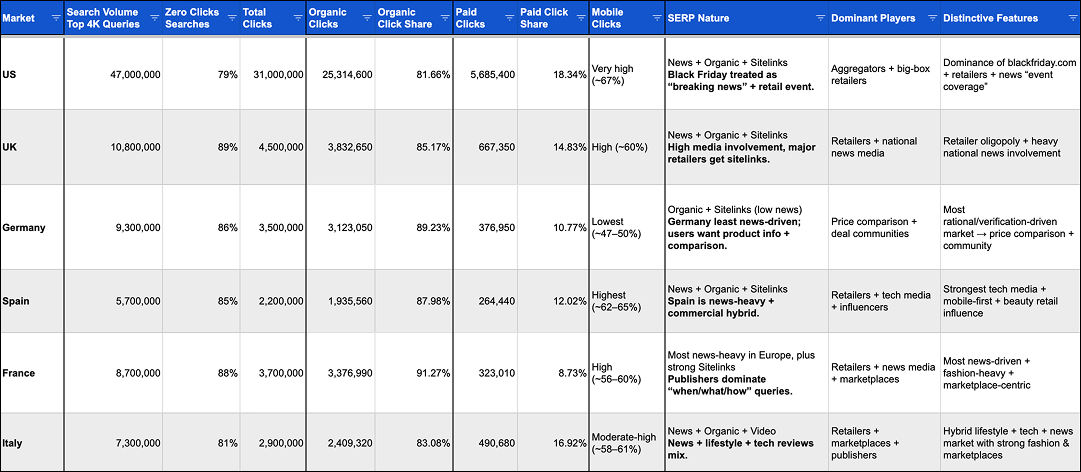

Here’s an analysis of organic search traffic insight from the US, UK, Germany, Spain, France and Italy from the last 28 days based on the 4,000 most popular “black friday” queries in each of these countries using Similarweb data:

Main Black Friday Search Traffic Patterns In The USA, UK, Germany, France, Spain, Italy

- Zero clicks searches: Only 11–21% of the 4K top Black Friday searches result in clicks.

- Mobile behavior: Spain + USA are the most mobile leaning, and Germany is the least mobile.

- YouTube is the universal winner. It’s in the top 3–4 domains in every market, that is simultaneously: Cross-market, High-ranking, and systematically enhanced by a Video SERP feature.

- A small core of global platforms and brands (YouTube, Facebook, Instagram, Reddit, Wikipedia, Apple, Ikea, PlayStation, Samsung, Zara, etc.) capture 16–27% of Black Friday clicks per country. The rest is lead by:

- Local/national retailers (top share in every market)

- News and magazine publishers

- Tech and review publishers

- Price comparison & deal communities (especially in Germany).

- Retailer lead is local, not global. Retailers hold a major share within each market, but mostly via country-specific domains:

- USA: bestbuy.com, walmart.com, target.com, costco.com, etc.

- UK: currys.co.uk, johnlewis.com, amazon.co.uk, etc.

- Germany: mediamarkt.de, amazon.de, otto.de, etc.

- Spain: mediamarkt.es, elcorteingles.es, pccomponentes.com, etc.

- France: boulanger.com, cdiscount.com, fnac.com, leclerc.fr, etc.

- Italy: mediaworld.it, unieuro.it, zalando.it, etc.

- URL patterns: “black friday” in the slug and short paths. Strong universal patterns from the highest ranking URLs of the winning sites:

- ≈80% of highest ranking URLs contain black-friday or blackfriday in the path.

- Black Friday winners almost always have explicit Black Friday targeted URLs, not generic /deals or /sale.

- They’re not deeply nested paths.

Let’s go through each country data:

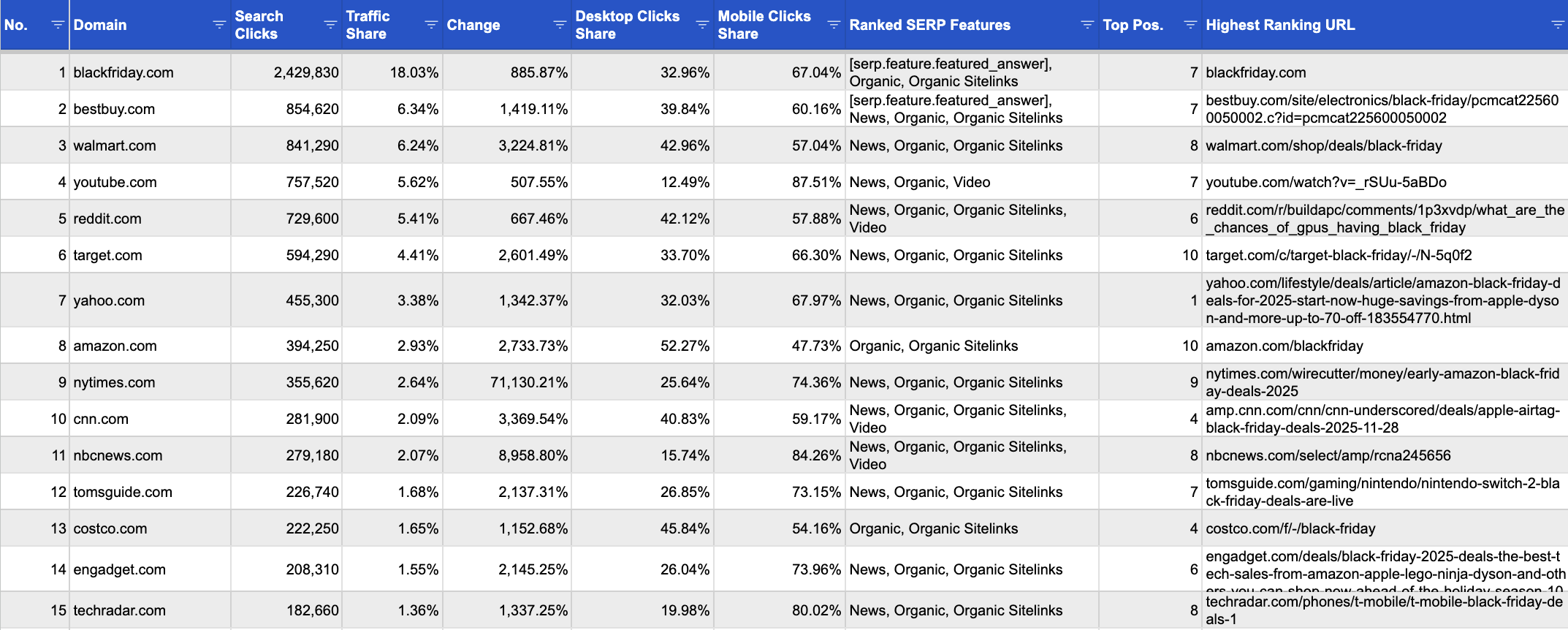

1. USA

Top winners:

- The top 3 sites attracting the most traffic are: blackfriday(.)com, best buy and walmart.

- The top retailers are best buy, walmart and target.

- The NY Times is in the top 10 thanks to the Wirecutter.

Traffic is highly concentrated in a small set of domains

- Top 5 domains (blackfriday.com, Best Buy, Walmart, YouTube, Reddit) capture ≈41.7% of all estimated clicks.

- Top 10 domains capture ≈57.1%.

- Top 20 domains already take ≈71.2%, and the top 50 take ≈87.6% of all clicks in this keyword set.

Retailers + Black Friday aggregators are the main winners

From the top 30 domains by traffic share:

- Retailers (bestbuy.com, walmart.com, target.com, costco.com, lowes.com, homedepot.com, amazon.com, etc.) together get about 24% of total traffic share in the top 30.

- Black Friday aggregators (blackfriday.com, theblackfriday.com) alone contribute about 19% of the top-30 traffic share.

- Social / platforms (YouTube, Reddit, Facebook) ≈ 11.7%.

- News publishers (nytimes.com, cnn.com, nbcnews.com, nypost.com, today.com, businessinsider.com, etc.) ≈ 9.6%.

- Tech/gaming review sites (Tom’s Guide, Engadget, TechRadar, IGN, etc.) ≈ 4.6%.

SERPs are heavily “eventified”: News everywhere

Google treats many Black Friday terms as a news/event + commercial hybrid intent and top stories / news results are a defining pattern for top performers.

Across the 100 top domains:

- News SERP feature present for 68% of domains.

- Organic sitelinks present for 66%.

- Video appears for 11%.

- Featured answers/snippets appear for 8%.

Most common feature combos:

- “News, Organic, Organic Sitelinks” – 30 domains.

- “Organic, Organic Sitelinks” – 24 domains.

- “News, Organic” – 20 domains.

Mobile first: ≈67% of clicks are mobile

Black Friday search behaviour is primarily mobile, especially for media, reviews, and gaming sites. Across all 100 domains: Mean mobile click share ≈ 66.9%.

Some domains are almost entirely mobile (≥95% mobile clicks), e.g.:

- gamespot.com

- pcworld.com

- pressconnects.com

- ynetnews.com

- 9to5google.com

Strong role of media and tech/gaming publishers

Beyond retailers, several clusters stand out:

- General news: nytimes.com, cnn.com, nbcnews.com, nypost.com, cbsnews.com, etc.

- Tech & electronics review sites: tomsguide.com, techradar.com, engadget.com, wired.com, pcworld.com, 9to5google.com, etc.

- Gaming & entertainment: ign.com, polygon.com, gamespot.com, kotaku.com, nintendowire.com, hbomax.com, nintendo.com.

These sites tend to:

- Target “best [product] Black Friday deals”,

- Publish product category guides, and

- Leverage authority and topical relevance in tech/gaming to rank for high-value categories (TVs, consoles, games, laptops, etc.).

Electronics and gaming are a major Black Friday demand driver. Authoritative review/gaming publishers capture a large chunk of that demand via roundups, buyer’s guides, and curated lists rather than raw product listings.

User-generated & social platforms are major discovery hubs

A large share of Black Friday discovery happens through UGC, video reviews, and community discussions.

Within the top 30 alone:

- youtube.com and reddit.com are both in the top 5 by traffic share:

- YouTube ~5.6% share.

- Reddit ~5.4% share.

-

facebook.com also appears in the top group.

-

These platforms regularly rank with:

- Deal roundups,

- Recommendation threads, and

- Influencer or creator content.

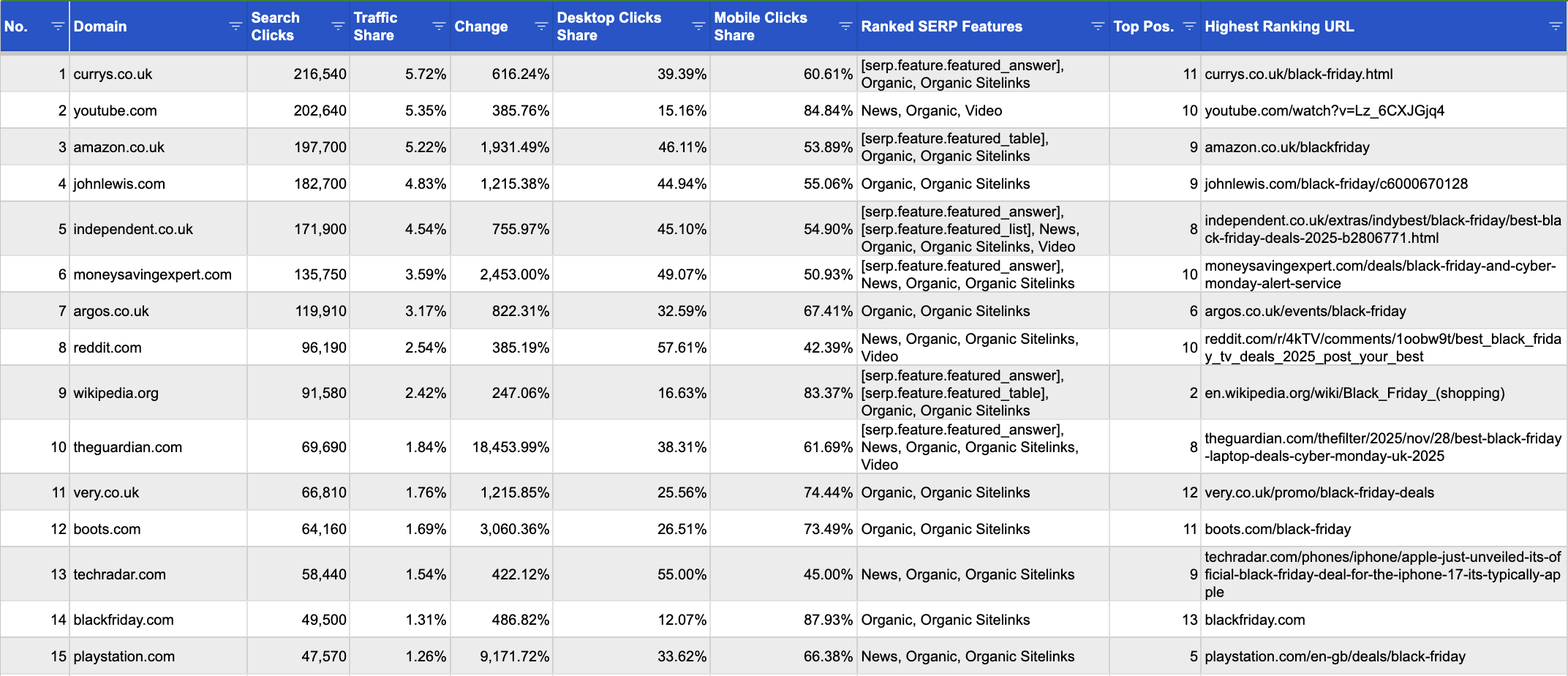

2. UK

Top winners:

- The top 3 sites attracting the most traffic are: currys, youtube, amazon uk.

- The top retailers are currys, amazon uk, john lewis, and argos.

- The independent is in the top 10 thanks to their indy best section.

Traffic is concentrated, but less extreme than in the US

In the UK, there is a longer “head” of strong players before the curve drops off. From the top 100 UK domains in your file:

- Top 5 domains capture about 25.7% of all clicks in this keyword set.

- Top 10 capture ≈39.2%.

- Top 20 capture ≈52.0%.

- Top 50 capture ≈67.0%.

Retailers are the clear winners in the UK

- Retailers account for roughly 38% of the clicks captured by the top 100 domains.

- News / media roughly 15%.

- Platforms / UGC (YouTube, Reddit, Facebook, Instagram, etc.) about 12%.

- Deals/aggregators (e.g., moneysavingexpert.com, blackfriday.com, pricerunner.com) about 7%.

- Brand manufacturers (Apple, PlayStation, Amazon corporate, etc.) about 5%.

- Tech/review sites (TechRadar, Which, etc.) about 4%.

Compared with the US data:

- The UK looks much more retailer-centric, whereas in the US, blackfriday.com + big retail + more fragmented aggregators were sharing the top of the chart.

- In the UK, classic high-street/e-com brands (Currys, John Lewis, Argos, Very, Boots, etc.) are structurally stronger.

SERPs are “event + evergreen” hybrids: news, sitelinks, and some featured answers

Google treats many Black Friday UK queries as a mix of commercial + news/event + informational intent.

From the ranked SERP features across the 100 domains:

- News appears for 47% of domains.

- Organic sitelinks show for ≈57%.

- Featured answers for ≈23%.

- Video for ≈9%.

Most common feature combinations:

- “Organic, Organic Sitelinks” – 33% of domains.

- “News, Organic” – 14%.

- “Featured Answer, News, Organic” – 12%.

- “News, Organic, Organic Sitelinks” – 11%.

- Simple “Organic” – 11%.

Mobile leaning, but less skewed than in the US

Mean mobile click share ≈ 54.5%. Compared to the US (where mobile hovered around two-thirds of clicks), the UK has a mobile majority, but with more balanced desktop traffic, especially on media, price comparison, and some international sites.

There are extremes:

-

Very mobile-heavy:

- lbc.co.uk – ≈99% mobile

- procook.co.uk – ≈93%

- britannica.com – ≈92%

- abc.net.au – ≈90%

- blackfriday.com – ≈88%

-

More desktop leaning:

- fandom.com – ≈24% mobile

- pcmag.com – ≈25%

- hm.com – ≈25%

- idealo.co.uk – ≈27%

- forbes.com – ≈27%

Strong presence of UK news / media and consumer advice brands

This is more structurally UK specific than the US.

-

News & media in the top positions include:

- independent.co.uk

- theguardian.com

- thesun.co.uk

- radiotimes.com

- dailymail.co.uk

- telegraph.co.uk

- manchestereveningnews.co.uk

- express.co.uk

- abc.net.au (international, but ranking in UK SERPs)

-

Consumer-advice / money-saving / comparison:

- moneysavingexpert.com (very strong, ≈3.6% share, top-10)

- pricerunner.com

- backmarket.co.uk (refurbished deals)

They tend to:

- Rank for “best [product] Black Friday deals”,

- Provide round-ups and buyer guides, and

- Capture users who want an independent overview before going to a retailer.

Platforms and UGC are critical discovery surfaces

As in the US, a significant share of search discovery for Black Friday UK runs through video and community content, not just retailer websites. The black friday SERPs systematically surface platform content where users expect real-world opinions, gameplay, or side-by-side comparisons.

Prominent platforms in the UK:

- youtube.com – #2 by traffic share.

- reddit.com – top-10, ≈2.5% share.

- instagram.com – in the top-30.

- facebook.com – in the top-30.

These typically appear for:

- Product specific deal searches (e.g., console, phone, TV, fashion deals).

- Unboxing / review / recommendation videos.

- Community deal threads and discussions.

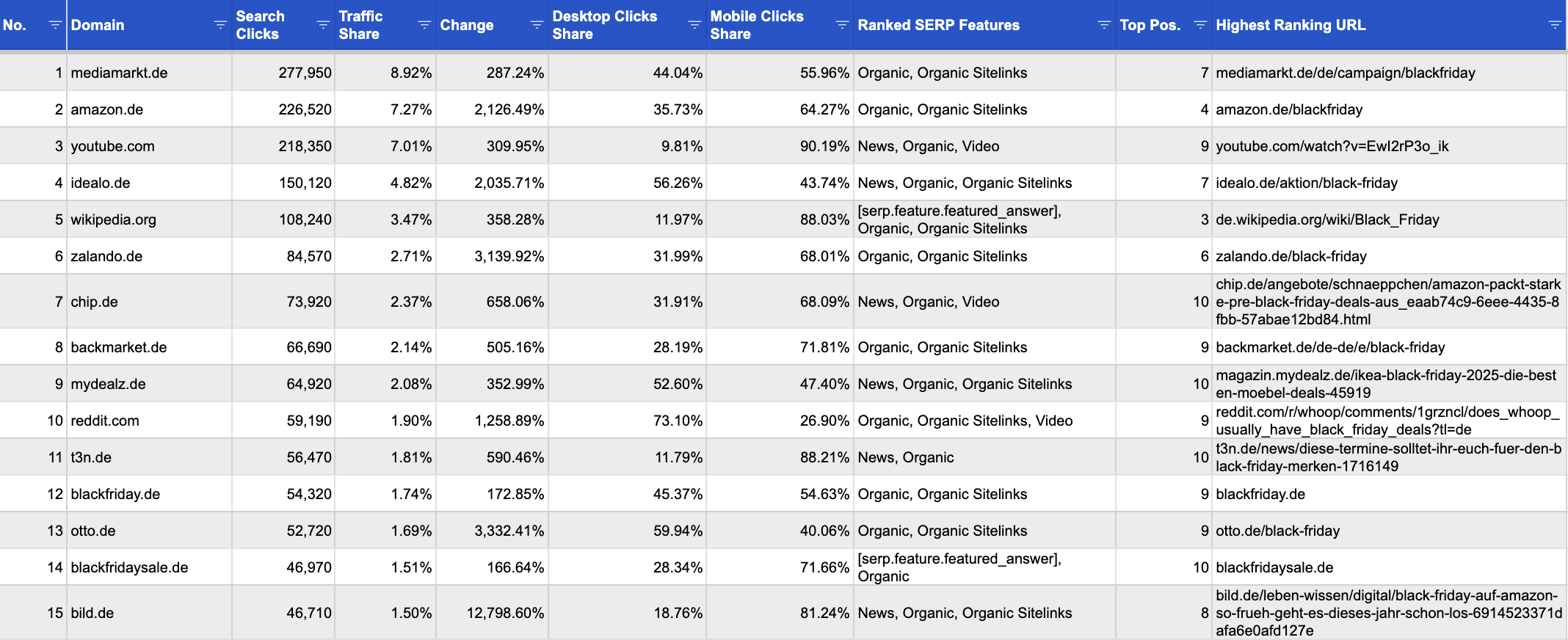

3. Germany

Top winners:

- The top 3 sites attracting the most traffic are: mediamarkt germany, amazon germany, youtube.

- The top retailers are mediamarkt germany, amazon germany, zalando.

- Idealo, a price comparison site is in the top 10 and ahead of retailers like zalando.

Traffic is highly concentrated but fragmented across fewer large retailers than in the UK or US

Germany resembles the UK in concentration but remains less influenced by a single giant than the US (where blackfriday.com + major retailers lead), it has more structured competition across retailers, price comparison ecosystems, and deal portals.

From the top 100 German domains:

- Top 5 domains account for roughly 23–25% of all clicks.

- Top 10 account for ≈38%.

- Top 20 ≈ 51–53%.

- Top 50 ≈ 69%.

Germany is the most price-comparison-heavy market vs the US, UK, Spain, France and Italy.

Germany shows a uniquely strong presence of price comparison engines & deal platforms, unlike the US or UK:

Top examples include:

- idealo.de

- billiger.de

- geizhals.de

- mydealz.de

- preis.de

- discounto.de

Combined, these comparison/deal ecosystems capture roughly 30% of all clicks in the top 100, which is far more than in the UK and significantly higher than in the US.

Retailers still win big but not as overwhelmingly as in the UK

In Germany, Media Markt + Saturn + Otto + Amazon share the “top retailer” space with strong competition from deal sites.

Top German retailers ranking strongly include:

- amazon.de

- otto.de

- mediamarkt.de

- saturn.de

- zavvi.de

- alternate.de

- lidl.de

- aldi.de

- ikea.de

However, Germany has a dual ecosystem, both are nearly equally important:

- Retailers

- Deal aggregators + comparison engines

SERP intent is strongly “commercial + verification”, not “commercial + news”

Germany does not treat Black Friday as strongly as a media event as the US, and news plays a smaller role than commercial and comparison results:

- Organic + Organic Sitelinks lead (>50% of domains).

- News appears far less than in the US

- Video features modestly (~8–10%).

Instead, German SERPs look like:

- Product lists

- Deal pages

- Price histories

- Verification content

Germany is more desktop-heavy than the US or UK

Germany is not mobile leaning for Black Friday queries with a mean mobile share of ~46–50%.

Some sites still see 70%+ mobile (community/deal-focused sites like mydealz.de). But major retailers like otto.de, mediamarkt.de, saturn.de, alternate.de show much higher desktop share.

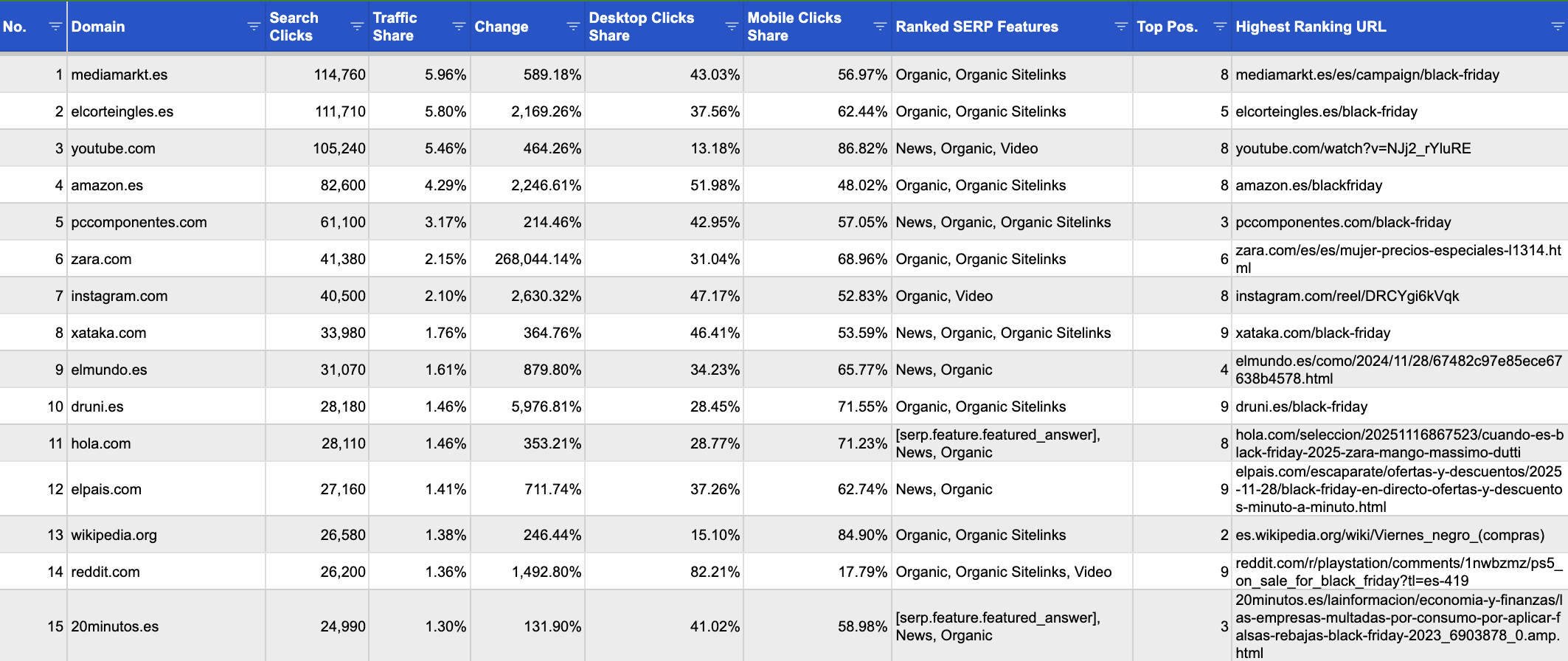

4. Spain

Top Winners:

- The top 3 sites attracting the most traffic are: mediamarkt spain, el corte inglés, youtube.

- The top retailers are mediamarkt spain, el corte inglés, amazon spain.

- PC Componentes is in the top 10 and ahead of retailers like zara.

Traffic is fairly distributed: more like Germany than the US or UK.

From the sites attracting organic search traffic from the most popular 4,000 Black Friday related queries in Spain:

- Top 5 domains: 24.7% of total traffic

- Top 10 domains: 33.7%

- Top 20 domains: 46.2%

- Top 50 domains: 65.0%

Spain looks structurally closer to Germany than to the US or the UK:

- No single aggregator leads (as in the US)

- No overwhelming retailer cluster (as in the UK)

Instead, traffic is spread across retailers, news media, and tech vertical content, it has a more balanced Black Friday SERP where many players participate meaningfully.

Retailers lead the top positions, especially electronics generalists

Retailers in the top-20 include: MediaMarkt, El Corte Inglés, Amazon, PCComponentes, Druni, Zara, Decathlon, Carrefour, Pull&Bear, Sprinter, Ikea, LeroyMerlin, and Primor.

Combined retailer share in the top-100 ≈ 40–42%, slightly higher than Germany but far lower than the UK.

Spain has a retailer-heavy Black Friday landscape, but it is not led by just 2–3 brands (like Currys/Amazon/John Lewis in the UK). Instead, there is a mid-sized cluster, especially in electronics, fashion, and beauty.

SERPs are led by “News + Organic” and “Organic + Sitelinks”

Black Friday in Spain is treated by Google as both a commercial event, and a media reported seasonal moment. with strong presence of:

- El Mundo

- 20Minutos

- El Español

- La Vanguardia

- Xataka / Webedia tech media

This shows a hybrid informational-commercial intent and makes Spain one of the most news-driven markets, along with France and the US.

Spain is mobile first

Spain is one of the most mobile-centric Black Friday markets. Across the top 100 there’s an average mobile share: ≈ 62–65% with strongly mobile-driven domains:

- Youtube.com: 87% mobile

- Zara.com

- Pullandbear.com

- Instagram.com (obviously)

- Druni, Primor (beauty retailers)

- Decathlon

Media / tech publishers are unusually strong in Spain

Spain’s online consumer culture is heavily shaped by Webedia, ADSLZone, El Español, and other media ecosystems.

Publishers occupy the upper funnel:

- “Mejores ofertas”

- “Qué merece la pena comprar”

- “Guías de compra Black Friday”

This is similar to the UK (Guardian, Independent, Telegraph) but in Spain, the tech vertical is more influential than the general news vertical.

In the top 20 alone:

- xataka.com

- elmundo.es

- 20minutos.es

- elespanol.com

- lavanguardia.com

Tech & consumer publications perform exceptionally well:

- Xataka (and its network: Xataka Android, Applesfera, Genbeta, etc.)

- Andro4All

- Computerhoy

- Movilzona

Fashion & beauty retailers are much stronger in Spain than in Germany, UK, US

Electronics still lead (Media Markt, Amazon, PCComponentes), but fashion is a larger share of Black Friday demand than in other countries.

Spain’s Black Friday demand has a stronger component of:

- Perfume & beauty

- Apparel

- Footwear

- Fast-fashion promotions

Examples ranking highly:

- zara.com (#6)

- druni.es

- primor.eu

- pullandbear.com

- sprinter.es

- mango.com

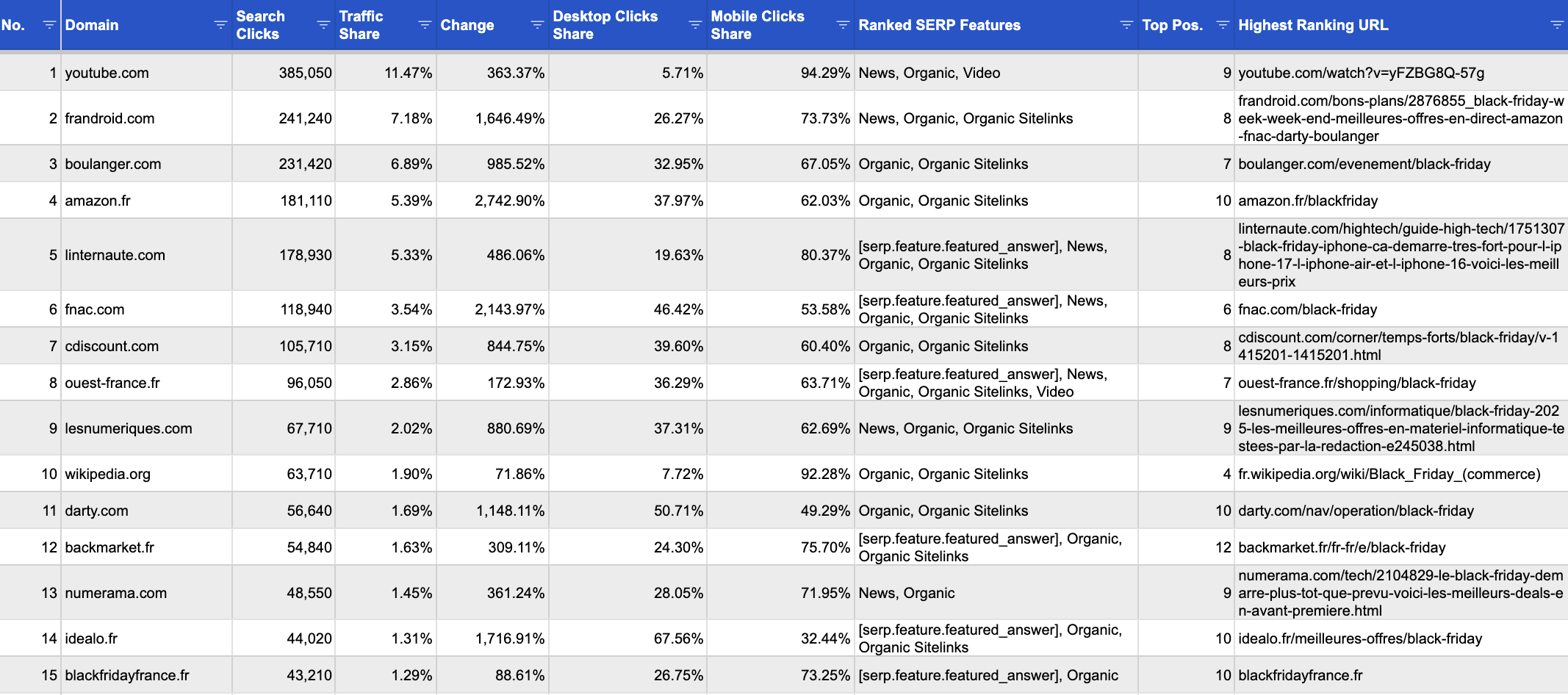

5. France

Top Winners:

- The top 3 sites attracting the most traffic are: youtube, frandroid, boulanger.

- The top retailers are boulanger, amazon france, fnac.

- Linternaute(.)com is in the top 10 and ahead of retailers like darty.

Traffic concentration: France is less concentrated than the UK/US, more similar to Spain/Germany

France mirrors the Germany/Spain pattern with no huge “Black Friday aggregator” influence (unlike the US with blackfriday.com) and no extreme retailer concentration (unlike the UK).

Instead, France has a balanced, multi-ecosystem SERP:

- Retailers

- Marketplaces

- Price-comparison engines

- Mass media

- Deal sites

- Luxury/fashion brands

This creates one of the most diversified Black Friday organic landscapes in Europe.

Retailers & marketplaces lead but with strong competition from media and deal sites

Retailers + marketplaces capture ≈40–42% of total top-100 traffic in France. This is very similar to Spain, and more distributed than the UK (where a few retailers lead the top). France also has the strongest fashion/beauty presence in Black Friday SERPs of any EU country besides Spain.

Electronics / general retail

- Amazon

- Cdiscount

- Fnac

- Darty

- Boulanger

- Leclerc

- Carrefour

Fashion / beauty

- Sephora

- Zara / H&M

- Lacoste

- Kiabi

- AboutYou

- Zalando

- Marionnaud

- Nocibé

- Veepee

France is a highly “news-heavy” Black Friday market, even stronger than Spain

France is even more media-driven than Spain.

Major French publishers ranking strongly:

- Le Parisien

- 20 Minutes

- BFMTV

- Le Figaro

- Capital.fr

- RTL.fr

- L’Internaute

- Challenges.fr

These publishers score heavily for:

- “Qu’est-ce que le Black Friday ?”

- “Quand commence le Black Friday ?”

- “Les meilleures offres Black Friday”

- Retail news

- Deal curation articles

This differs from Germany, where news barely plays a role, and from the US/UK where news appears but is less vertically specialized.

Mobile leads but desktop remains stronger than in Spain/US

The average mobile click-share across the top 100 ≈56–60%.

- Retailers skew closer to 55% mobile

- Media skews mobile (60–70%)

- Comparison sites skew more desktop (40–50%)

France is mobile-first, but not as mobile leaning as Spain (≈65%).

Deals sites and price comparison engines play a medium but important role

Not as powerful as Germany, but stronger than the UK. Notable deal sites are:

- dealabs.com

- idealo.fr

- priceminister/rakuten

- Kelkoo

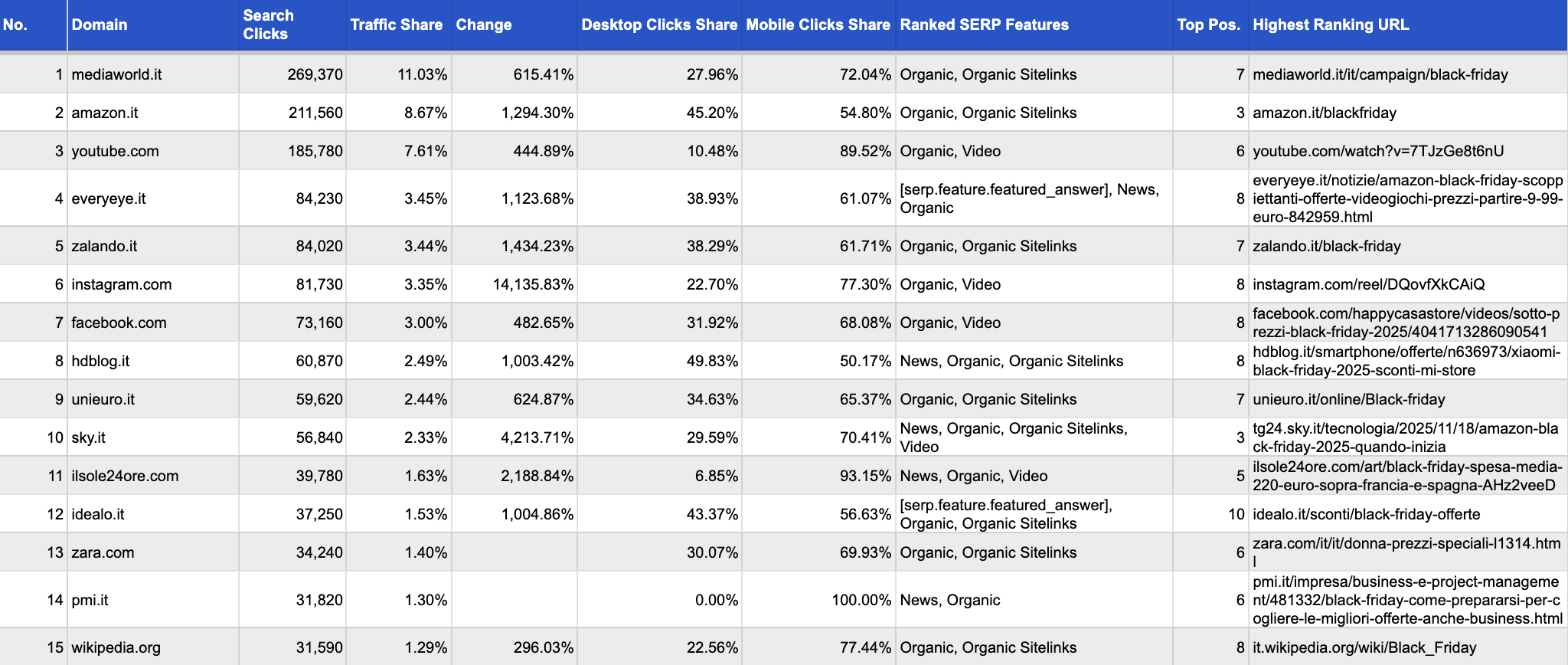

6. Italy

Top Winners:

- The top 3 sites attracting the most traffic are: mediaworld, amazon italy, youtube.

- The top retailers are mediaworld, amazon italy, zalando.

- Everyeye is in the top 10 and ahead of retailers like zara.

Traffic concentration: Italy is similar to France & Spain, not too top-heavy

Italy behaves like France and Spain:

- Broad competition across retailers, publishers, marketplaces, fashion brands, tech media

- No leading aggregator

- No single retailer monopoly (unlike UK)

From the top 100 domains ranking for the 4,000 most popular black friday related queries:

- Top 5 domains: ~23% of all BF clicks

- Top 10: ~34%

- Top 20: ~46%

- Top 50: ~66%

Retailers lead the top positions, especially electronics & multipurpose retail

Italy’s Black Friday ecosystem has a top-heavy electronics influence, but fashion/beauty plays a far bigger role than in Germany or UK.

Key retail verticals:

- Electronics (MediaWorld, Unieuro, Euronics, Amazon)

- General retail (Iper, Carrefour)

- Gaming & entertainment (Gamestop, Nintendo)

- Fashion & beauty (Zalando, Sephora, Douglas, OVS, Calzedonia, Zara)

The Italian SERP is highly news-driven, one of the strongest “news ecosystems” in Europe

Italy behaves similarly to France: Black Friday is treated as a news event as well as a commercial event.

Google ranks trusted Italian publishers for:

- “Quando è il Black Friday”

- “Migliori offerte Black Friday”

- “Black Friday: cosa conviene comprare”

- “Sconti, promozioni, negozi aderenti”

This hybrid intent is much stronger than in Germany or UK.

Italy is moderately mobile-first — less than Spain/US, more than Germany

Italy is closer to Spain/France in mobile behaviour as users browse deals & fashion on mobile but electronics are still researched on desktop more frequently. It’s not as desktop-leaning as Germany but not as mobile leaning as Spain.

Mobile share across the top 100:

- Avg ~58–61%

- Median ~60%

However, this changes per vertical:

- Media sites: very mobile (65–75%)

- Fashion/beauty: very mobile (70–85%)

- Electronics: more balanced (55–65% mobile)

- Hardcore comparison / tech review sites: more desktop (45–55%)

Tech publishers and lifestyle magazines have very strong Black Friday authority

Similar to Spain and France, Italy is highly influenced by:

- Lifestyle journalism

- Tech journalists

- Sponsored deal roundups

Top Black Friday tech/lifestyle media include:

- HDblog

- Wired.it

- Tom’s Hardware Italia

- DDAY.it

- Fanpage

- Today.it

These sites rank heavily for:

- Smartphone deals

- TV deals

- Laptop deals

- Gaming promotions

- “Migliori offerte Black Friday…”

Fashion & beauty are very strong categories

Italy’s Black Friday demand has unique emphasis on:

- Fashion

- Beauty

- Perfumes

- Lingerie & hosiery

- Luxury & premium brands

This is more prominent than in UK/DE but similar to FR/ES.

Within the top 100, several strong fashion/beauty domains appear:

- Zalando

- Sephora

- Douglas

- OVS

- Calzedonia

- Intimissimi

- Zara

- H&M

- Guess

- Foot Locker

- Decathlon

Marketplaces are very strong, stronger than in Spain and UK

Italy stands out for:

- Strong adoption of flash sales sites (Veepee, Privalia)

- Higher influence of fashion-first marketplaces

- Higher share of Amazon- and eBay-driven discovery

This differs from Germany (comparison-driven) and Spain (retailer-driven). Key marketplaces:

- Amazon.it

- eBay.it

- Zalando

- Veepee

- Privalia

- AboutYou

- AliExpress

Top Black Friday Organic Search Performers SEO Learnings and Recommendations

1. Still today, it pays off to build & maintain an evergreen “/black-friday/” hub.

~80% of top-ranking Black Friday URLs across markets contain /black-friday/ in the slug.

2. Create category specific Black Friday landing pages: these are the universal top click drivers.

Category-intent pages (“Black Friday TV deals”, “Black Friday laptop deals”) are the strongest performers globally. They match high-intent searches across all 6 markets. Build a Black Friday landing page structure like:

- /black-friday/tv-deals/

- /black-friday/laptop-deals/

- /black-friday/smartphone/

- …

3. Prepare content that qualifies for News + Organic hybrid SERPs.

Black Friday is treated as a news + shopping event by Google. In US, UK, France and Spain, over 50% of top domains include “News” as a SERP feature. Create editorial Black Friday content targeting relevant topics in your industry like: “What to expect for Black Friday in [sector]”.

4. Create video content: YouTube is the only universal winner across all markets.

YouTube ranks in the top 3–4 domains in all 6 countries. It is the only domain consistently paired with Video SERP features.

5. Adopt comparison-style pricing blocks: Essential for Germany, beneficial everywhere.

Germany is the only market where price comparison engines lead Black Friday SERPs (~30% of clicks). But even outside Germany, Google increasingly prioritizes deals grids, price comparison, and structured lists.

Add persistent comparison elements to category pages:

- Price grids across merchants

- “Cheapest today” indicators

- “Was / Now” pricing

- “Price dropped X% since last week”

- Prime/non-Prime pricing differences

- Stock and delivery estimates

Even if you aren’t a comparison engine, comparison UX wins.

6. Ensure mobile usability: mobile clicks represent 54–68% across markets

It’s then a must to ensure mobile usability with:

- Fast product grid loading

- Lazy-load images

- Reduce interstitials

- Sticky filters

- Prioritize scroll-first design