In 2025, Google’s product search results have dramatically evolved, turning into a feature-rich, visually dynamic landscape that resembles a product listing page (PLP) more than traditional search results. These changes are reshaping user behavior, SEO strategies, and what it takes to succeed in ecommerce search visibility.

Here’s a comprehensive look at how ecommerce SEO has changed, why it’s more difficult than ever, and what you can do to adapt and continue growing.

Google’s Product SERPs: The New Ecommerce Battlefield

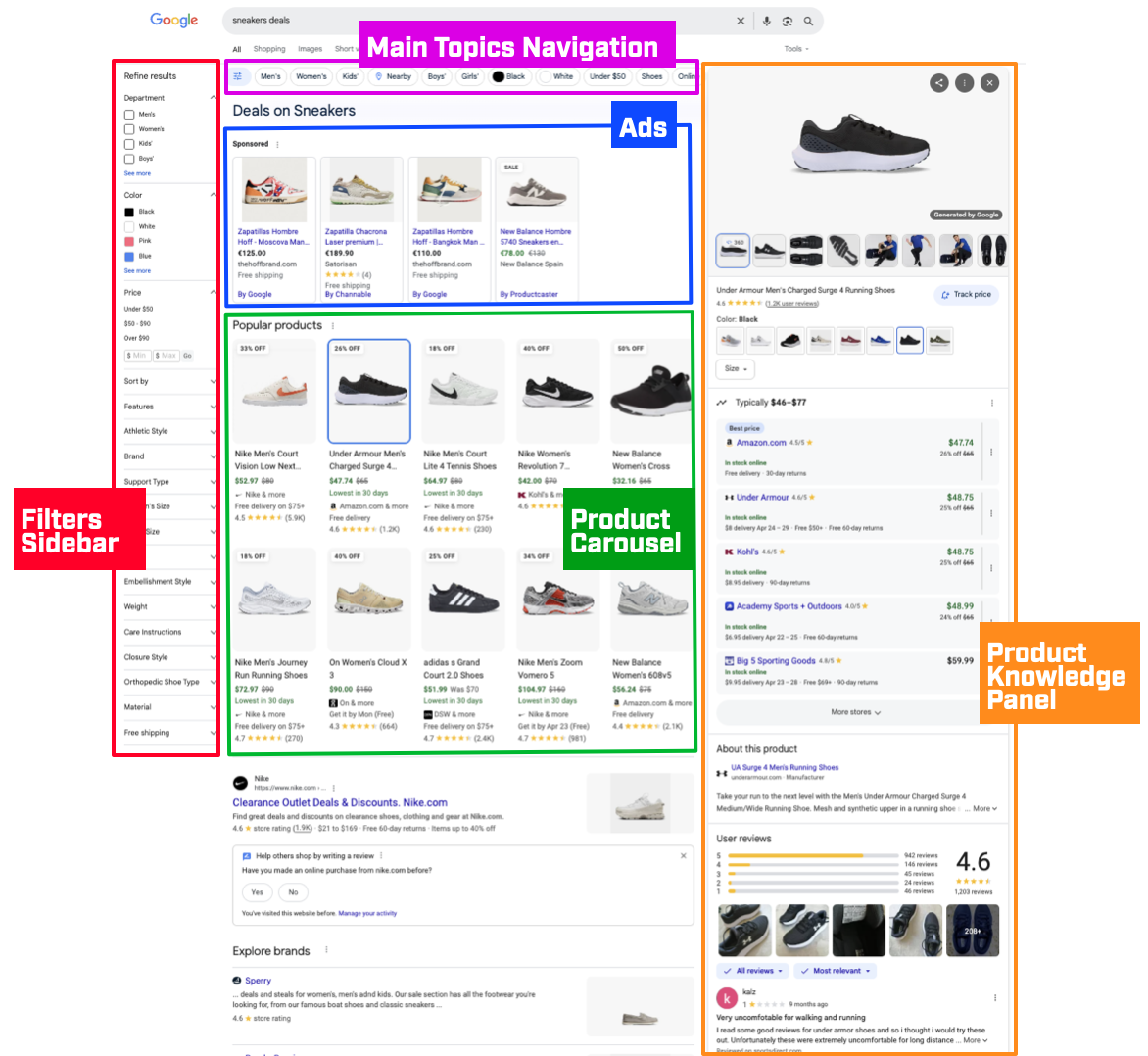

Google is positioning itself as the ultimate shopping destination. Its product SERPs now feature:

- Product Carousels and Knowledge Panels

- Explore Brands and “People Also Buy From” features

- Deals-specific experiences (especially during events like Black Friday)

- Expert guides, user-generated content (UGC), and reviews

- AI-generated overviews (AIOs), slowly becoming more common

These changes mean Google is competing with retail and product affiliate sites for attention and clicks, turning search into an integrated shopping journey.

1. How have organic search results & SERP features inclusions changed in product SERPs in the last year?

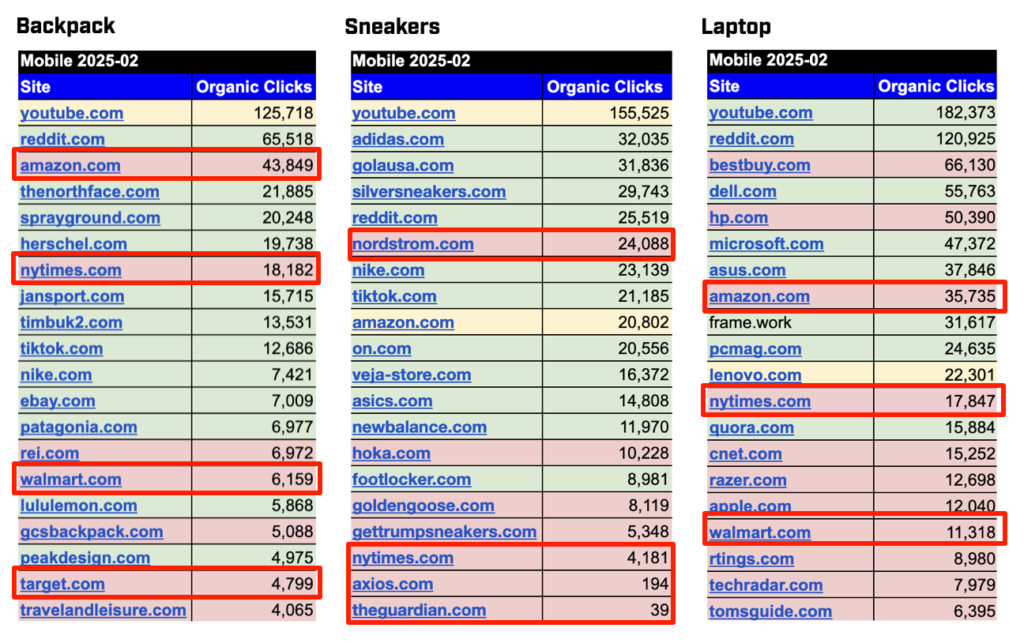

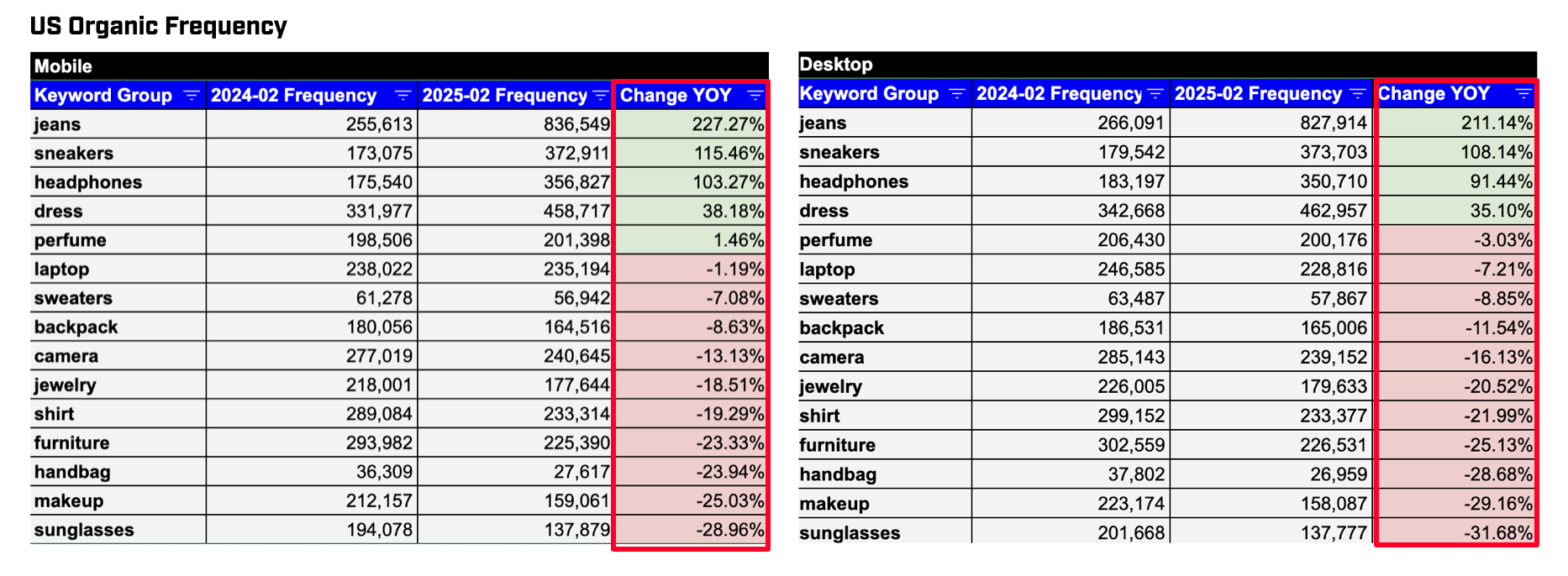

Researching using data from Similarweb and Advanced Web Ranking across the top 10K queries in 15 verticals revealed the following from an organic search visibility standpoint:

- Traditional organic results saw a frequency YOY decrease across most product SERPs

- Forum sites in organic search results grew YOY on mobile across most verticals

- Something similar happened on Desktop, showing a YOY increase in Forum results

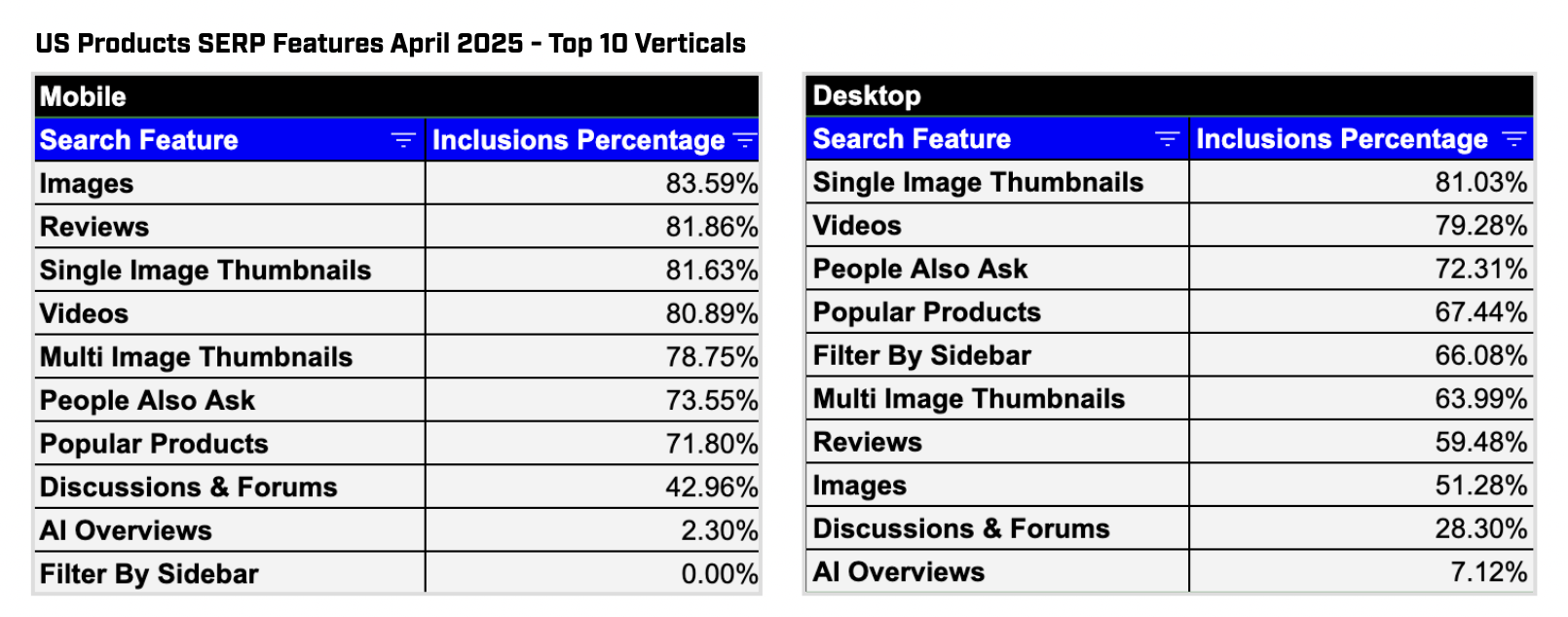

- Images, Reviews & Single Image Thumbnails are the most popular features on Mobile

- Single Image Thumbnails, videos and PAAs are the most popular features on Desktop

- AI Overviews inclusions in ecommerce are trivial when compared to other features, but growing a lot, especially on mobile

- Reviews & Popular Products are the most frequent Product oriented features on mobile, while Popular Products, Filter by Sidebar & Reviews included in most Desktop SERPs, followed well behind by Explore Brand in both mobile and desktop SERPs

- Popular Products is the top product feature across verticals, with the highest YOY growth

- Images saw a mixed YOY shift, decreasing in half verticals and increasing in the others

- Videos are still popular but went through a decrease YOY among most verticals

- Related questions saw an important increase YOY, with forum inclusions in them, this happens in both mobile and desktop SERPs across 15 product verticals

So yes, top products SERPs have gone through a major transformation last year, with an important decrease in traditional organic search results, an important increase of forum sites in organic search results, with images, reviews & single image thumbnails, videos being the most popular features on Mobile, included on +80% SERPs, and with popular products being the ones that have increased the most, featured in +71% mobile SERPs and 67% Desktop.

2. How are these organic search results & SERP features inclusions and shifts impacting click behavior?

Google’s expanded features have contributed to a rise in zero-click searches:

- Zero click searches have slightly increased across most 15 US product verticals YOY. For example, in Laptops top 10K queries SERPs, from 67.1% to 69.6% or for Jeans top 10K queries SERPs, from 67.9% to 69.2%. The biggest zero clicks growth happens with Headphones with a +4.63% increase.

- However, there are also slight decreases like backpacks from 68.6% to 67%, with the biggest zero clicks decrease happens with Dresses SERPs with a −3.51% decrease.

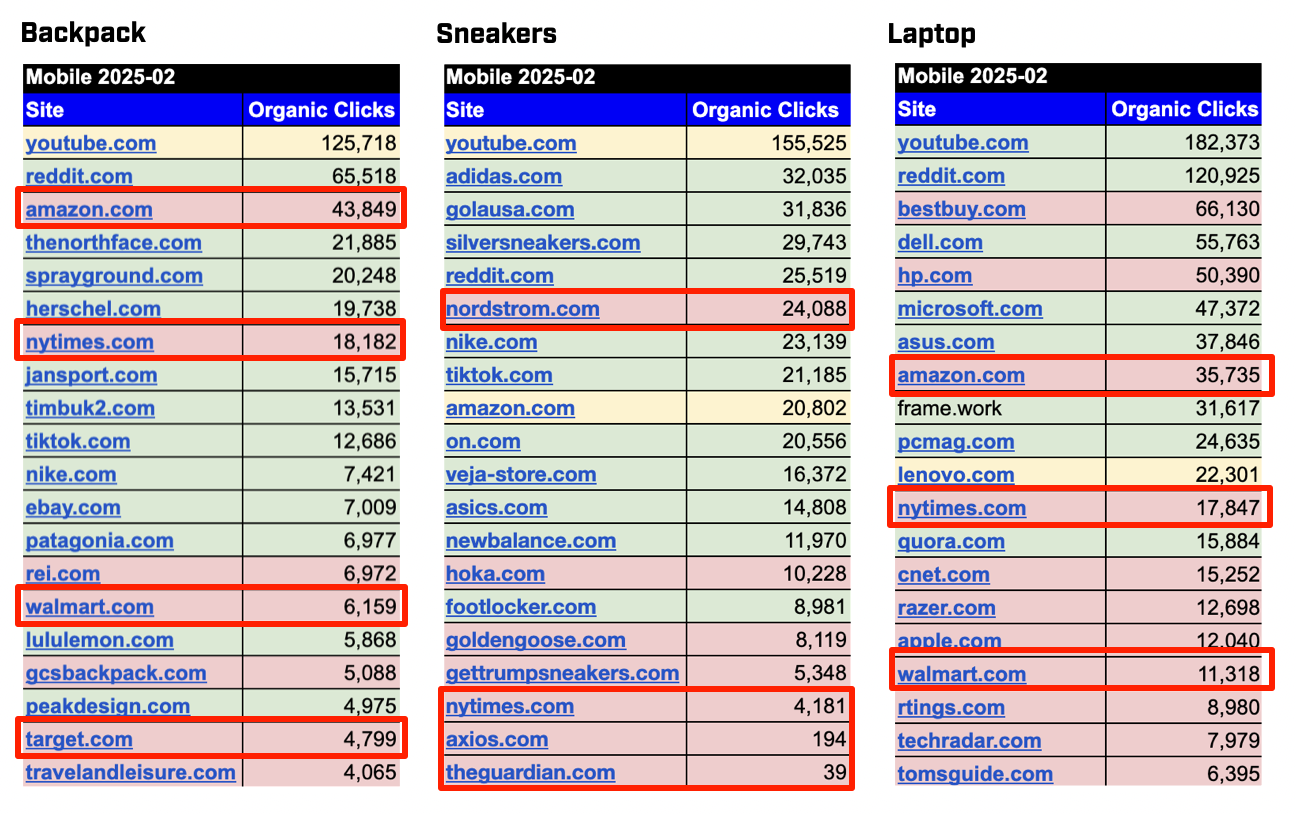

There are also clicks shifts among top ranked sites! Here are the top 3 increasing and decreasing in clicks from Jan 2024 to Feb 2025 on Mobile across verticals (with a similar click shift happening in Desktop too):

- The most common sites with an increase of organic clicks on mobile across all verticals are social and UGC: reddit, instagram and tiktok

- The most common sites with decreased clicks on mobile are publications (techradar, guardian) and retailers (Macys, Target)

Many retailers and publications that dropped across verticals are non-specialized. For example:

- For the top 10K Backpack queries: YouTube¡ is first, Reddit, North Face up, & Amazon, NYTimes down. If we zoom in on YouTube clicks, they’re going to URLs ranked in Video SERP Features.

- For top sneakers queries: YouTube is first, Axios, Guardian down, Adidas and Reddit up. But if we view clicks per URLs, it’s not YT but retailers & brands that get most clicks.

- For top laptop queries: YouTube first, Amazon, Walmart down; while YouTube & Reddit up. In the case of top retailers & brand sites, clicks go to URLs leveraging many features. There’s also a very long tail of clicks going to product detail pages besides relevant PLPs. This aligns with ecommerce platforms showing a major trend of PDP traffic growth.

So, as we can see, Zero clicks searches have mostly slightly increased across top Product queries YOY, with social and UGC, along with brands getting more clicks; and non-specialized publications and retailers getting fewer clicks from top Product queries.

It’s important to note how a high share of clicks are going to a higher number of URLs showcasing SERP features: videos, products, images, news, etc. and a higher number of PDPs are getting clicks from top product queries than before thanks to Product related SERP features.

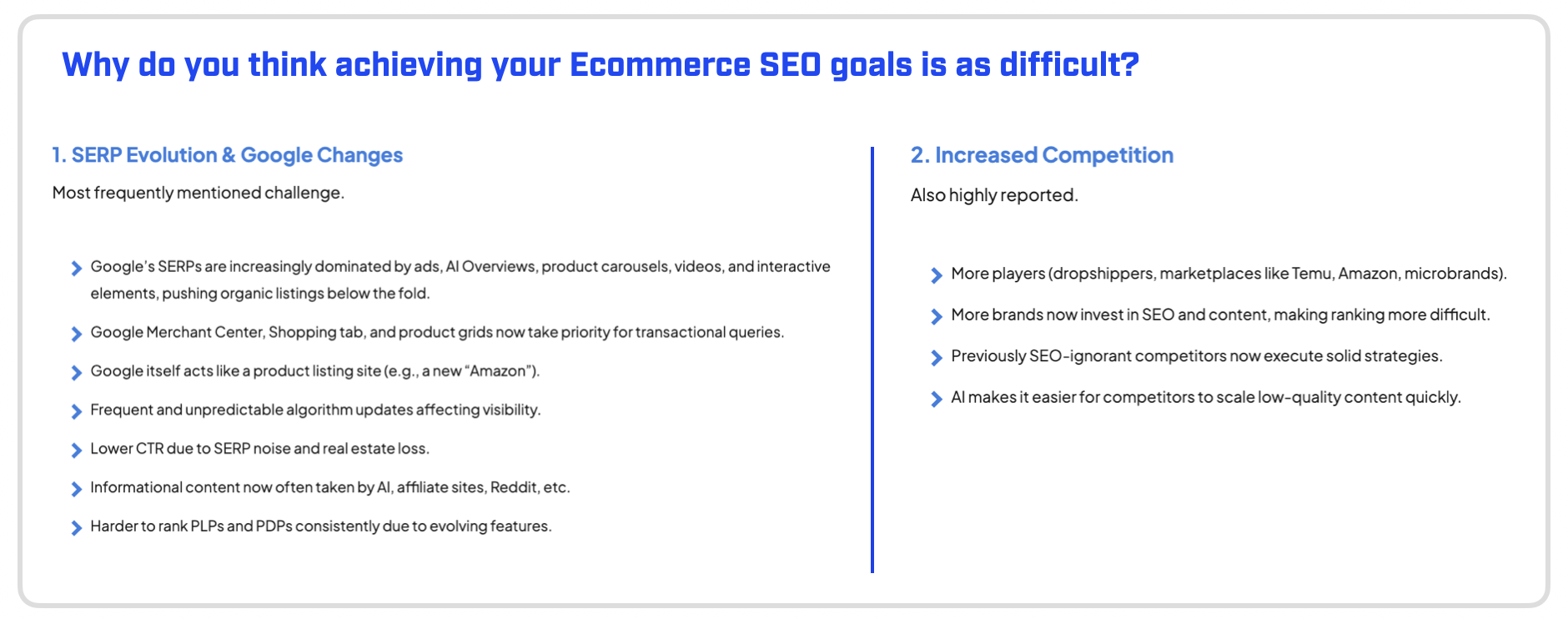

It’s definitely getting harder to achieve ecommerce SEO goals, it’s not only you, the SEOFOMO Ecommerce SEO Survey answers have confirmed this, and the main reason is exactly this: SERP Evolution and Google Changes.

3. What should ecommerce SEOs do to keep winning despite these shifts in SERP Features & traffic behavior?

Here are 3 key steps for ecommerce organic search growth in 2025:

- It’s time to double down your PDPs optimization efforts to maximize your SERPs visibility and be ready for the next AI shopping features (without neglecting your PLPs).

- Grow your brand authority with specialized informational and commercial multi-format content to become more popular & competitive.

- Track pixel visibility, features and clicks behavior to fuel an “ongoing testing” approach to quickly identify & assess SERP opportunities and keep winning.

Let’s go through actionable steps to make them happen!

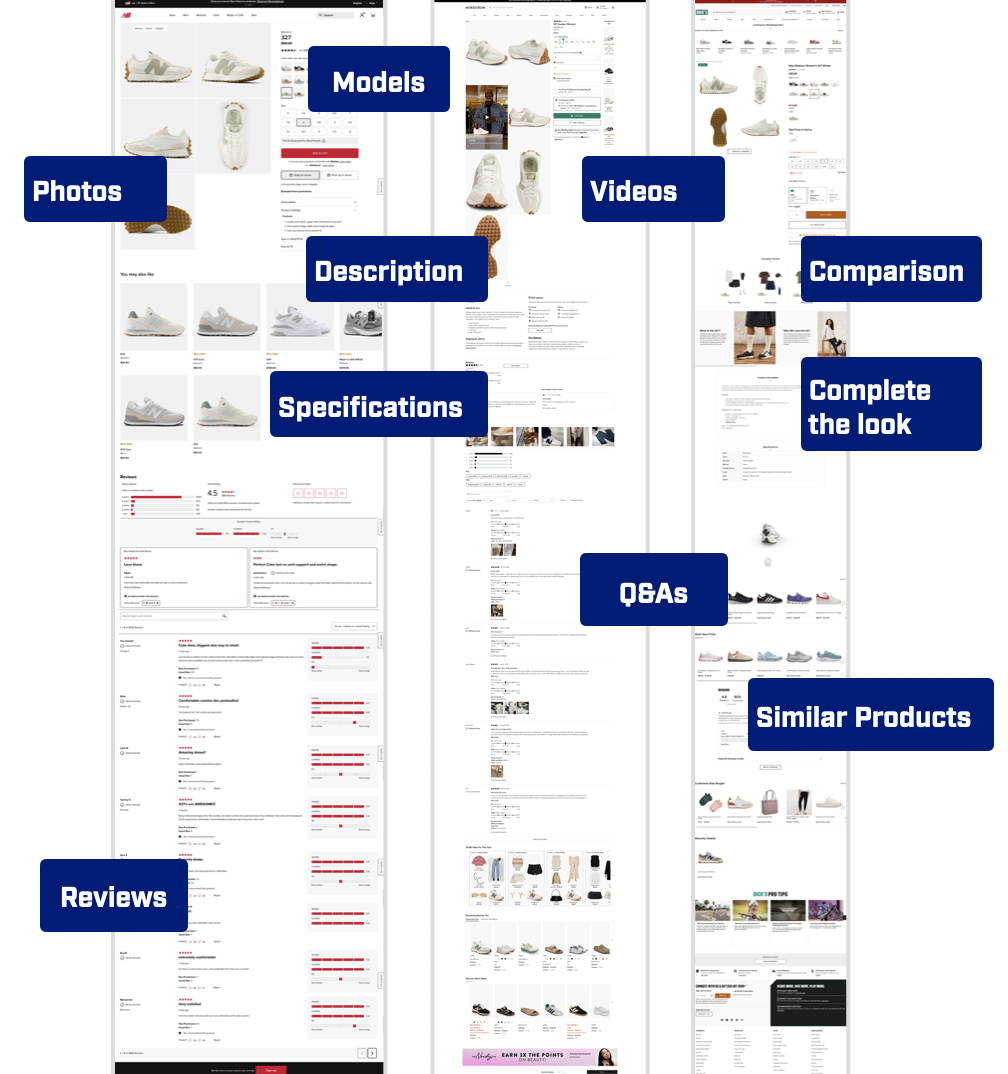

PDP Optimization

Start with the PDPs indexability which is usually a challenge! Their content needs to be as unique, descriptive engaging and well linked as possible. Your goal is to make your PDP information and experience more fulfilling to compete with best performing ones.

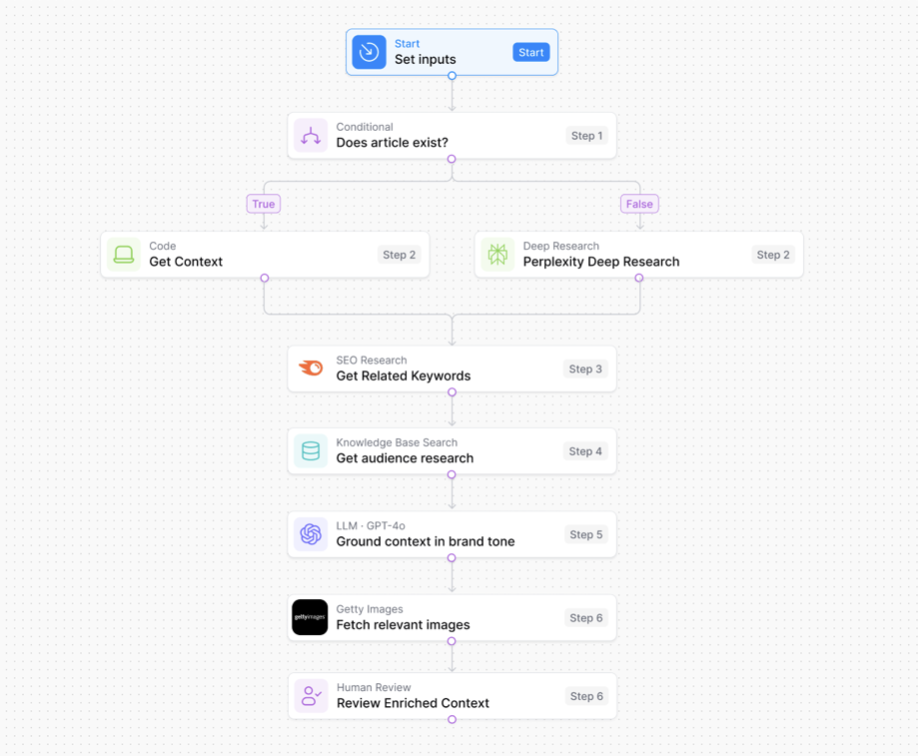

Have resource issues to implement? You’re not alone. Most in ecommerce SEO have them too. You can use AI platforms like AirOps for workflows that automate tagging and help to enrich your product at scale using your own store data or Wordlift that can generate a full product knowledge graph with descriptions & FAQs. Besides content you can also use these tools to automate internal links to related products with rules you set. Do you think is too risky? Your ecommerce SEO competitors are already leveraging AI: From content creation & optimization, keyword research to repetitive SEO tasks automation.

It’s also a must to integrate with Google merchant center for PDPs visibility in product packs which can be easily implemented via platforms and apps. Even though most do it, there are still 18% of ecommerce sites that haven’t yet. Merchant Center Product Feed Optimization is also gaining relevance as one of the top ecommerce SEO activities to prioritize this year. Google has now made it easier than ever to monitor product feeds issues with the merchant opportunities report. If your store platform doesn’t generate a product feed, use 3rd party solutions like the WordLift Product Knowledge Graph Builder for it.

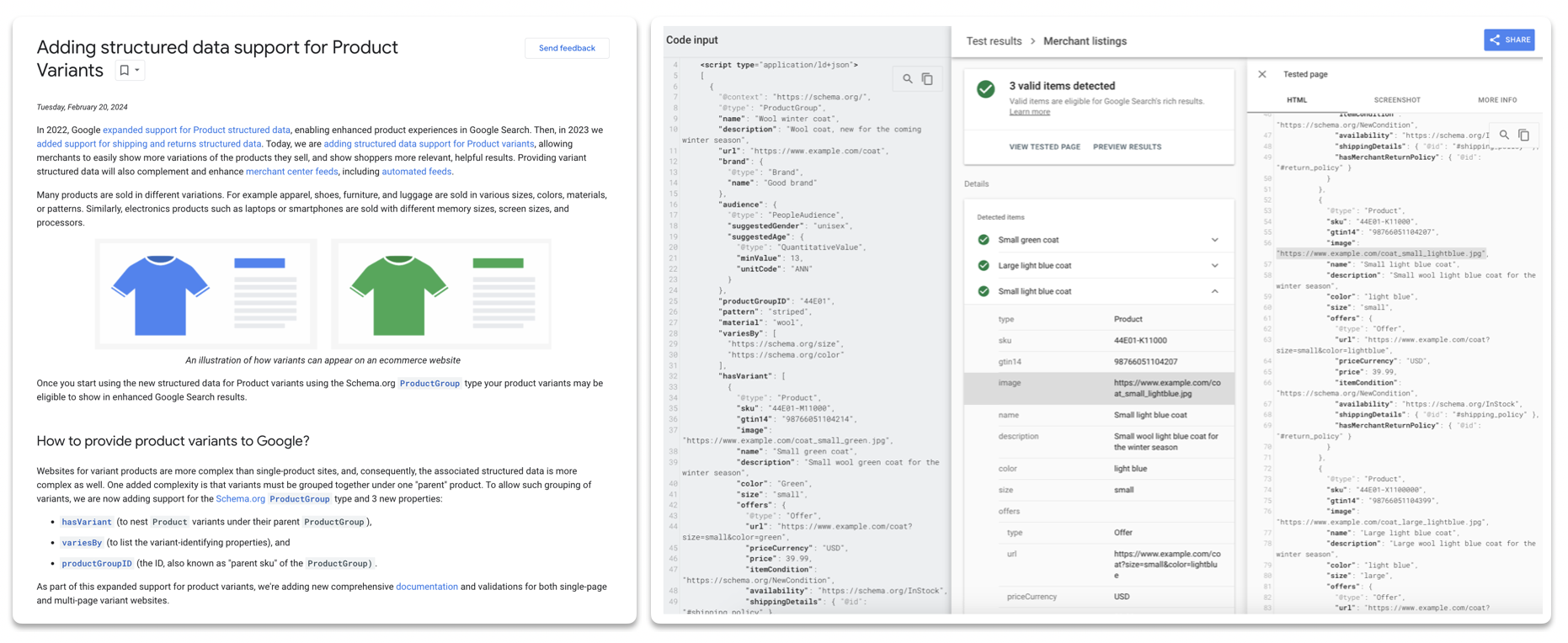

Ensure parity of merchant center feed with structured data, using all supported properties. Eg. Implement the product variants structured data in case you haven’t yet. I would have prioritized facets for product color queries before, now PDPs variations. Check this excellent guide by Brodie Clark going through product rich results types and what triggers them, to prioritize them.

Monitor beyond invalid items, check the “improve item appearance” report from the Google Search Console product & merchant listings to validate and fix.

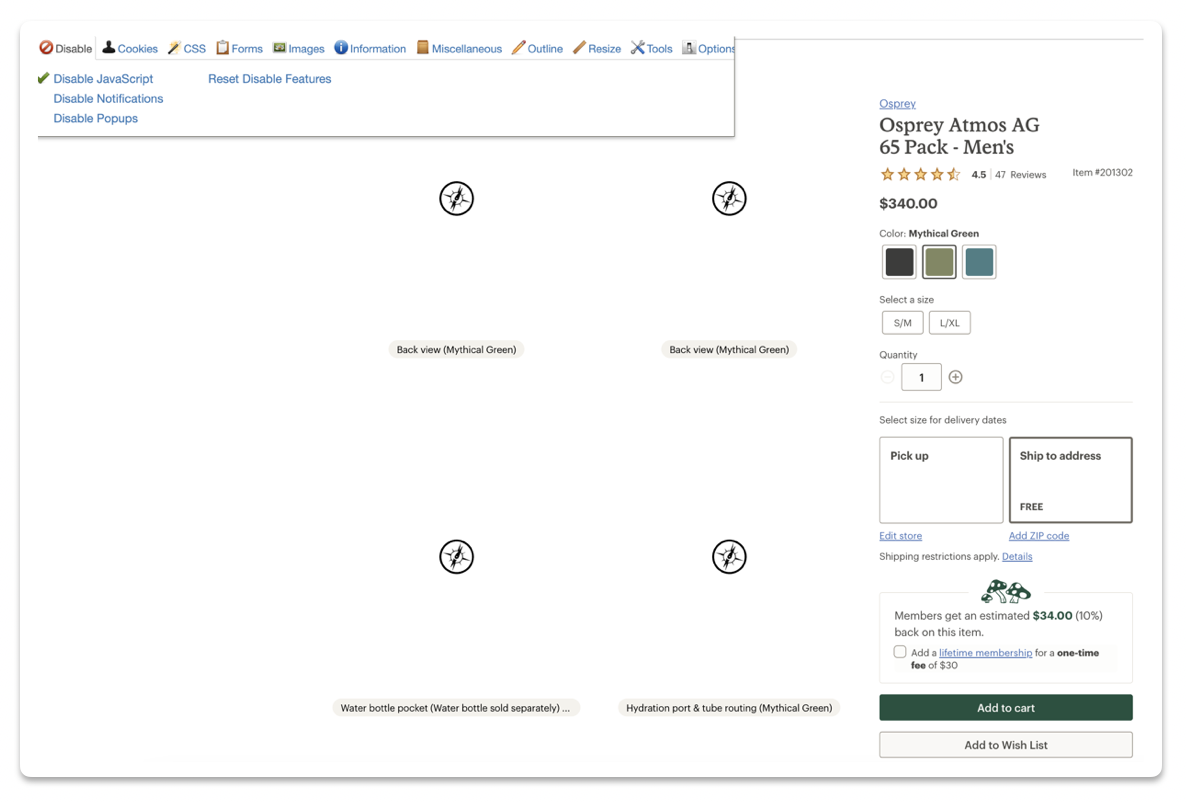

Something also important is to avoid structured data implementation with CSR JS. Not only reviews, but also descriptions or images end up over-relying on CSR JS, making it challenging for Google to index at scale. You don’t want to rank well just to get less visibility than the pages below due to the lack of thumbnail and search features. Always validate CSR JS reliance of key PDPs areas triggering features with crawlers & Google Search Console. If you can’t SSR, go for hydration or pre-rendering natively or via a 3rd party solution.

For thumbnails & image packs, it’s not only about your products images indexability but about size and relevant descriptions too. Image optimization is now fundamental due to thumbnails, image packs and Google lens. Despite the impact of images in SERPs, a high number of SEOs haven’t taken action yet. Follow Image Optimization best practices:

- Crawlable <img src> based (not background, no CSR JS)

- Supported image format: BMP, GIF, JPEG, PNG, WebP, SVG, and AVIF

- Image XML Sitemap

- Responsive Images

- Descriptive ALT Text

- Descriptive File Name

- High quality, resolution

- Optimized for speed

- Structured Data.

Create a PDP/PLP benchmark to assess the gap vs top players per vertical, to prioritize efforts and gain support. Use the Ecommerce Product Page Optimization Checklist to avoid missing anything out. You also have the Ecommerce Product Page Validator GPT to support you with the process.

Monitor search features shifts and SERPs visibility beyond traditional position

It’s also critical to monitor what’s going on in the SERPs and the impact of your efforts but 31% of SEOs are not yet tracking search features. More measurement is needed! Although AIO’s in Ecommerce is trivial, 27% of SEOs are not sure of their impact:

- Monitor the changing PDPs pixel visibility & search features for potential issues with tools like Advanced Web Ranking.

- Validate features shown in ranked SERPs but not linking to your PDPs for opportunities.

- Identify those products search features triggered by competitors you haven’t yet.

- Compare the before and after in traffic of any SERP feature: for this, you can watch how to assess AIOs impact here.

- Set alerts to be warned whenever important visibility and SERP feature inclusion changes

![]()

Create, optimize and integrate top of the funnel content to establish authority

Remember to also look at the SERPs! How can you stand out and better fulfill users intent? Many times is not with a PDP or PLP.

- More commercial product queries SERPs are also less transactional and more blended than before featuring expert reviews and UGC. Ecommerce sites are not keen to invest on top of the funnel content, but you can’t expect users to trust you over others to buy, if they have helped them first and they don’t recognize you.

- Google has shared they want to show “real” brands with expertise & experience in SERPs, Affiliates still growing for product queries show real specialization, expertise, strong topical authority, and excellent UX; also in SERPs full of features, creating a brand users recognize is also key for trust & CTR.

- If you have already the expertise, why leaving publications to profit from an increasing number of relevant product commercial queries? This content will establish topic authority, brand recognition and attract backlinks.

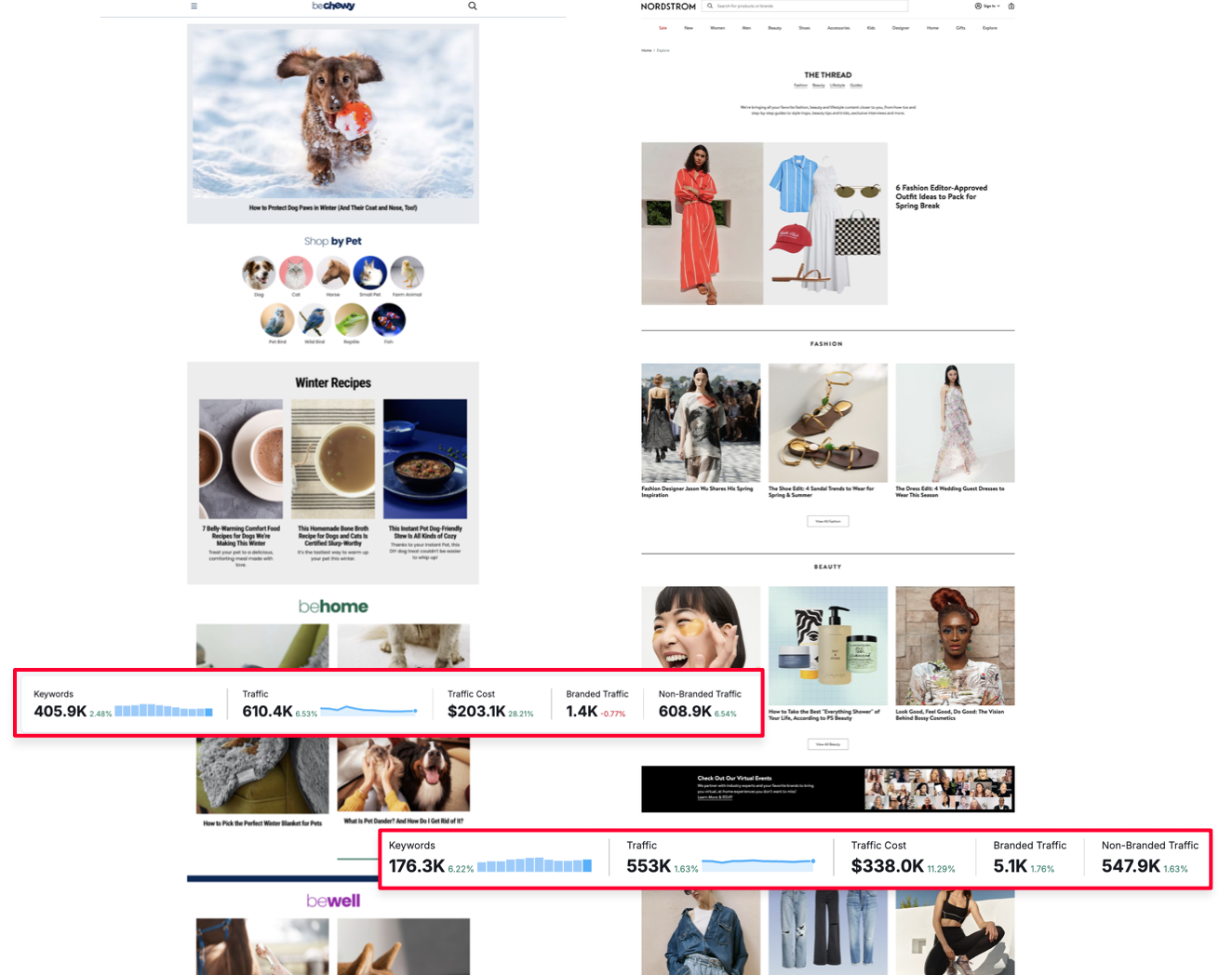

- See what Nordstrom is doing with fashion inspiration and tips, and what Chewy does with pets advice. Note how such a high share of these queries are commercial & transactional, that can be tied to your product offering.

Here are steps to create and optimize this content cost-effectively:

- Assess for which of your targeted topics this happens, and where the traffic is actually going: Which are the pages attracting most of the clicks for the top terms? What’s their nature? Use topic clustering tools like Keyword Insights to assess traffic opportunity. You can use Similarweb for this.

- It’s key this content also refers to the next steps of the purchase journey, linking to PLPs/PDPs when relevant. Integrate it within your PLPs/PDPs design in a way that is actually helpful to users.

- You can also leverage this content to enrich your PDPs with expert & UGC insights. This will allow your PDPs to rank better while also supporting product conversion.

- Need more inspiration to start? Check out Sistrix analysis of Retail visibility leaders, it features top performing retailers, going through examples & how they’re winning.

- Test before fully implementing to assess the impact in your own context & get buy in. It’s about prioritizing what matters the most and being prepared to identify shifts.

The alignment of all these to give the best shopping experience will make you win. Too difficult? These are great news for your competitors because they’re planning to do it. Remember it’s all about the revenue and ROI growth.

Go through the presentation I did about this at SEOWeek

You’ll find more examples and screenshots covering it: